In this article, I will review the latest charts which show the speculative craze the stock market is in. Then, I will update you on the latest information on the GOP’s healthcare plan. On Tuesday, the NFIB will release its latest survey on business optimism; it has been the poster child for the positive survey data. It’s not that I don’t believe small business owners. I do believe them when they say their current business is weak; I simply disagree with the opinion that the future will see improvements.

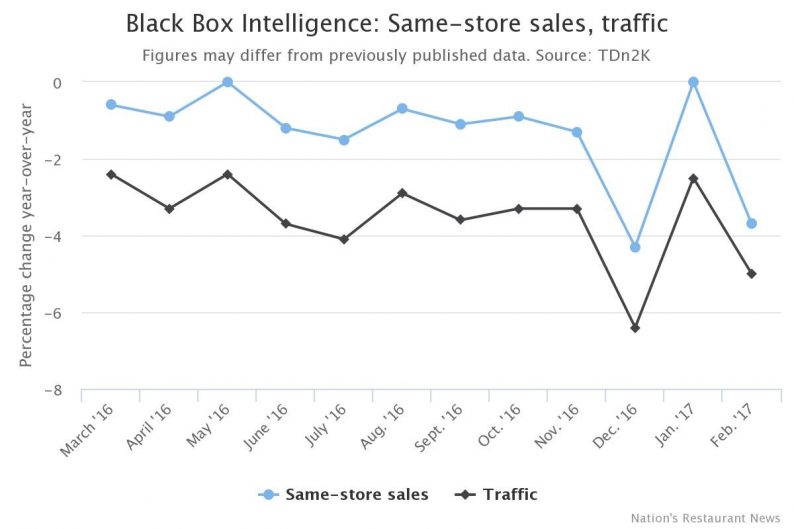

Restaurant Sales Plummet

As you can see from the chart below, restaurant sales have dipped lower in February. Restaurant same store sales fell 3.7% and traffic fell 5.0%. This makes February year over year sales one of the weakest months in the past 4 years. It continued the trend of negativity. Even with the blip higher in January, same store sales have still averaged a 2.7% decline in the past three months. One bright side for restaurants is the recent decline in oil prices may encourage consumers to eat out more. Restaurants will need all the help they can get because guests’ checks in February only grew 1.2% which was the slowest growth in four years. On the negative side, the tightening lending standards for credit cards means consumers will have less flexibility with their disposable income which will crimp the amount of times they can eat out.

Are There Any Shorts Left?

As I mentioned equity bullishness has reached a fever unlike we’ve seen since the 1990s. The chart below shows the level of short interest in the S&P 500. It hit a record low on March 7th. This isn’t surprising because the VIX has an 11 handle and market hasn’t seen a 5% correction in months. The shorts sellers have long gone home. An earnings recession, low GDP growth, and two shocking elections could not bring the market down. The Fed raising rates this year may be the catalyst for the downturn in stocks, but short sellers won’t be profiting off it.

Leave A Comment