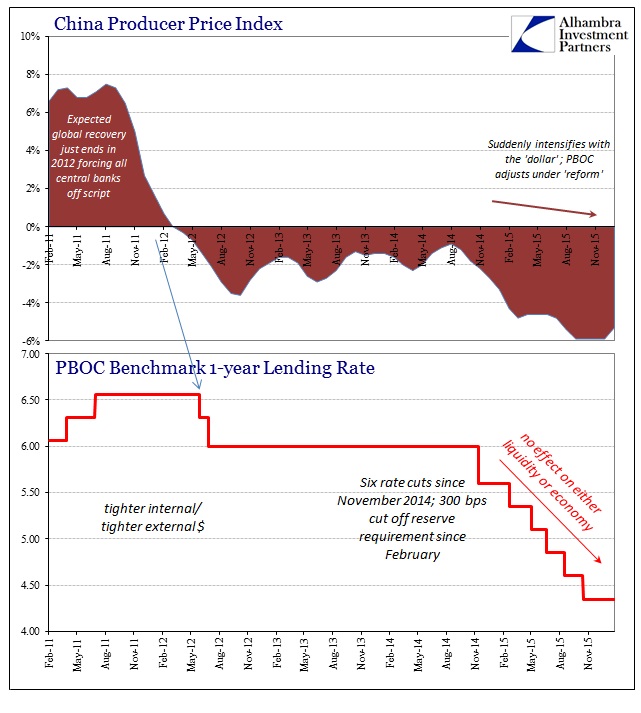

The PPI estimate for China was not a fifth straight -5.9%, instead the estimate for January 2016 was -5.3%; not appreciably different but at least not blatantly sticking with a single number. China’s CPI remained below 2% at just 1.8% in January, showing that as far as calculated “inflation” none of the PBOC’s massive efforts since November last year have made any impact. That much was clear via the atrocious trade figures released for January, so at least the consistency of central bank failure remains.

The continuously negative PPI estimates declare overcapacity and the sudden shift in “demand” around the start of 2015. It is the hallmark of recession, where businesses from China and beyond are subjected to more desperate selling of goods at appreciable discounts. The longer it drags on without abatement or equalization between production and sales, the more drastic measures must be taken not just in terms of prices but more so in terms of actual production – explaining the very good correlation between a sustained negative PPI in China and global recession.

What is more interesting and certainly more important is how that observation extends across the Pacific to the US PPI. There is at this stage an alarming correlation between “overproduction” in China and apparently the same condition in the US. Obviously with US manufacturing showing increasingly serious recessionary tendencies, the combination with Chinese prices leaves less doubt as to the primary source; both US production and Chinese production is in very large part destined for US consumers. Therefore, the tight correlation between the US PPI and the Chinese PPI is an indication of global recession with US consumers “somehow” (given the unemployment rate) at the center of it.

It is all far too explicit and makes too much sense which is why it has been removed from Janet Yellen’s economy in favor of “transitory” oil prices or other such nonsense. Even the effects of oil can be denied as import price “deflation” from whatever other source country suggests the same kind of economic difficulties.

Leave A Comment