The Fed has many problems with its attempt to convince the world that it has itself fulfilled its recovery mission. That self-reflected “mandate” is meant to include a masterful revisit to prior American infatuation with debt and credit. There was no more visible and visceral demonstration of those terms than the middle 2000’s, and it is the intent of monetary policy to get Americans back there. In 2015, however, in the few areas where that has been found it does not identify monetary success but rather demonstrates even more how the theory never came close.

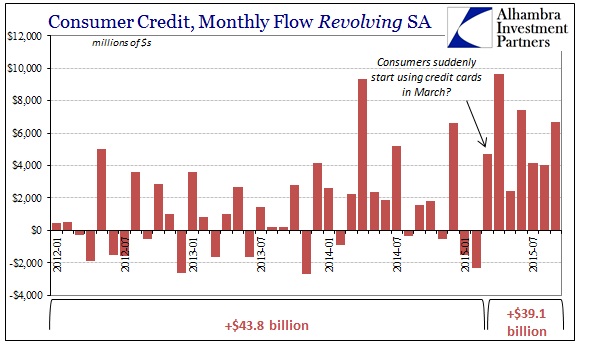

Revolving credit has just surged this year, particularly starting in March. The numbers are staggering, as revolving credit balances, estimated and reported by the Federal Reserve itself, have jumped by more than $39 billion in the seven months ending with the update for September. By comparison, from the start of 2012 until February 2015, revolving credit balances expanded by about $44 billion; in just seven months this year consumers have indebted themselves by almost as much as they had in the more than three years before March.

Economists are, as you would expect, nearly ecstatic over the impoverishment. To them, it signals the final capitulation of consumers to that which Janet Yellen has been professing since her term began. But there is a huge problem with that view; if consumers are borrowing, what are they doing with the balances?

For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. Combined, imports at the container terminals at the ports of Los Angeles, Long Beach, Calif. and around New York harbor, which handle just over half of the goods entering the country by sea, fell by just over 10% between August and October.

The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge through U.S. ports. It is a crucial few months for the U.S. economy as well: High import volumes can signal a confident view on the economy among retailers and manufacturers, while fears of a slowdown grow when ports are quiet.

Leave A Comment