The Containers – Paper And Packaging industry has been gaining from continued demand growth, backed by new technology and innovative products, as well as a relatively stable supply-and-demand balance. Growing urbanization, development of retail chains and promising healthcare and cosmetics sectors are spurring demand for containers and packaging, mainly in emerging economies.

Most of the companies in the Containers – Paper And Packaging industry serve a wide variety of markets, mainly catering to the food-and-beverage, household products, and pharmaceutical sectors. Also, the evolution of e-commerce has significantly impacted demand in the industry with every passing year. Going forward, packaging players are likely to gain from capitalizing on growing global demand for eco-friendly biodegradable packaging materials aided by environmental concerns.

However, escalating raw-material costs due to the imposition of tariffs is now a major drawback for the industry as it affects industry margins. Thus, the companies have to pass through as much of the raw-material price inflation as possible to customers in order to remain competitive.

Industry Underperforming S&P 500 & Sector

Looking at shareholder returns over the past year, it appears that a tough operating environment has been plaguing the Containers – Paper And Packaging industry’s performance. Further, the industry is facing competition not only from direct competitors, but also from the constant threat of substitution by alternative product materials.

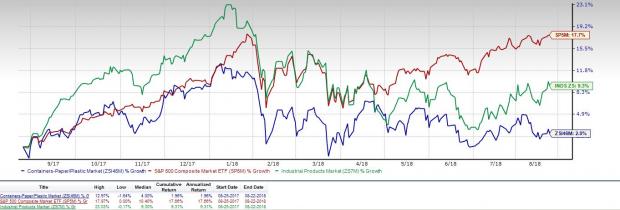

The Zacks Containers – Paper And Packaging, which is a 9-stock group within the broader Zacks Industrial Products Sector, has underperformed the S&P 500, as well as its own sector, over the past year. While the stocks in this industry have collectively gained 2%, the Zacks S&P 500 Composite and Zacks Industrial Products Sector have rallied around 18% and 9%, respectively, during the same time frame.

One-Year Price Performance

Group Trading Cheaper Than Sector

Regardless of the underperformance of the industry over the past year, its valuation hardly looks cheap now. The Containers-Paper And Packaging industry’s valuation could be roughly assessed on the basis of its EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio performance.

The Containers, Paper And Packaging industry is a capital-intensive industry with high fixed costs. Therefore, even a marginal dip in revenues might affect the bottom line to a large extent, as companies are unable to reduce costs in order to offset the impact on earnings. Thus, the EV/EBITDA multiple is a preferred valuation metric for such industries that have significant fluctuations in earnings from one quarter to the next.

Going by this multiple, the valuation for the Containers- Paper And Packaging industry looks a bit stretched, at the moment, when compared to the broader market and its own sector.

The industry has a trailing 12-month EV/EBITDA ratio of 12.3, which is currently below its one-year median of 12.9. However, the industry compares unfavorably with the market at large, as the trailing 12-month EV/EBITDA ratio for the S&P 500 is 11.7 and the median level is 11.5.

Leave A Comment