We will post a 35-minute video update to the World Economic forum (see “Helpful Video” thread) that will cover key markets.

We have warned that January looked like a correction all around. Wall Street rallied after a hesitant start on Thursday as oil prices led the way after surging with a big gain. ECB President Mario Draghi raised hopes of further stimulus, which has done nothing anyhow. This is becoming like a person who gets married for the fifth time expecting ever-lasting love — the ultimate triumph of hope over experience.

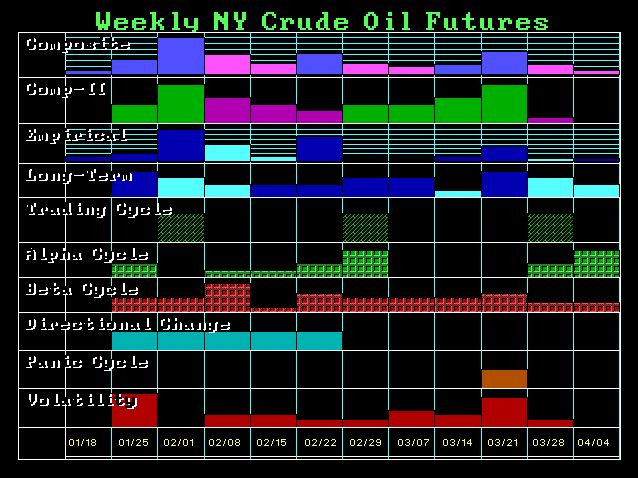

Nevertheless, our models on oil were reaching critical major support for the year. The oscillators (stochastic) were also at extreme lows. Our Global Market Watch warned of a Waterfall the week of January 11. This global model will be available on the Trader version of Socrates. The Investor version is gear to long-term investors and the Global Market Watch will appear for the monthly to yearly levels, limited to the region of the subscription.

This is beyond artificial intelligence — this is a full-blown machine learning model since it does everything on its own. Socrates is monitoring patterns of everything globally while differentiating the slightest divergences among markets. I personally believe that this model will ultimately prove to be the end of human analysis since it does what it would take an army of analysts to do, and even then someone would still have to merge at the top all the analyses from individual markets. That seems to be beyond human ability.

The Global Market Watch on the Dow picked the May high last year and the key low at 15370 on the monthly model, but the last month is dynamic so that comment will change as the final period unfolds. Once complete it no longer changes. So as of last week, the monthly level warned of new lows under 15842.

The weekly level went into crash mode the last week of December. So again, this has done a pretty good job from a pattern recognition perspective.

Leave A Comment