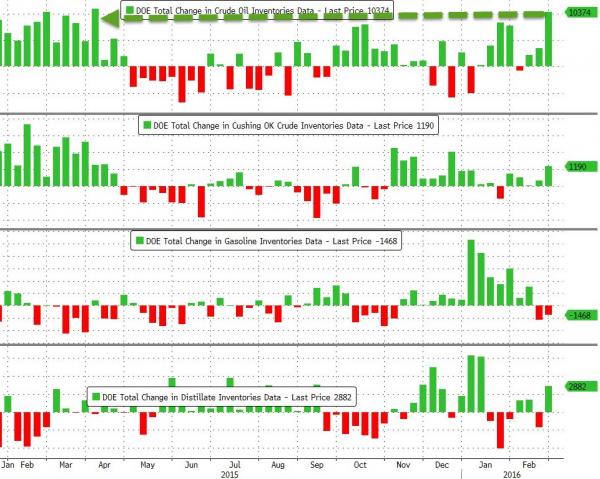

Following last night’s yuuge inventory build reported by API (+9.9m) and large rise in Cushing levels (+1.8m), DOE reported a crude build of even yuuger 10.37mm barrels (against the 7.1mm expectation) – the largest since early April 2015. Cushing saw a 1.2mm build – the most in 3 months. On the other side of the ledger, production fell for the 6th week in a row (-2.6% YoY to lowest since Nov 2014). Crude prices recovered from API’s losses as algos ran stops on the back of headlines about Saudi increases prices to Asia but DOE’s headline sent WTI back to its lows.

API:

DOE:

Which means Cushing has seen inventory builds in 16 of the last 17 weeks…

As storage concerns are becoming extreme…

As we detailed previously...Genscape joins the ever louder chorus that the US is approaching the capacity tipping point:

Production is at its lowest level since Nov 2014, and is now down 2.6% YoY (the biggest YoY drop since Aug 2012)

But while US production is down, US imports (of cheap Iranian oil?) are at their highest in 2 years…

As refinery throughput is at a seasonal record… (ready for another glut in gasoline?)

Crude, after weakness from last night’s API data, rallied this morning as algos latched on to Saudi price rises to Asia (running stops to the API level)…

Charts: Bloomberg

Leave A Comment