Trade data headlines show the trade balance improved insignificantly from last month. Our analysis paints an improving picture for trade using the rolling averages.

?

?

Analyst Opinion of Trade Data

Our monthly analysis using unadjusted data showed imports declining and imports growing. But the data in this series wobbles and the 3 month rolling averages are the best way to look at this series. The 3 month averages are improving.

Import goods growth has positive implications historically to the economy – and the seasonally adjusted goods and services imports were reported up month-over-month. Econintersect analysis shows unadjusted goods (not including services) growth decelerated 2.7 % month-over-month (unadjusted data) – up 2.4 % year-over-year (up 0.6 % year-over-year inflation adjusted). The rate of growth 3 month trend is improving (rate of change of growth is accelerating).

Exports of goods were reported up, and Econintersect analysis shows unadjusted goods exports growth acceleration of (not including services) 3.2 % month-over month – up 5.6 % year-over-year (up 4.6 % year-over-year inflation adjusted). The rate of growth 3 month trend is accelerating.

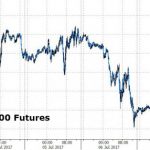

Inflation Adjusted But Not Seasonally Adjusted Year-over-Year 3 Month Rolling Average – Goods Export (blue line) and Goods Import Excluding Oil (red line)

?

?

z trade2.PNG

The improvement in seasonally adjusted (but not inflation adjusted) exports was attributed to capital goods. Import growth was due to industrial goods and industrial supplies.

The market expected (from Bloomberg) a trade balance of $-45.5 B to $-42.0 B (consensus $44.9 billion deficit) and the seasonally adjusted headline deficit from US Census came in at $44.3 billion.

It should be noted that oil imports were down 2 million barrels from last month, and up 14 million barrels from one year ago.

The data in this series is noisy, and it is better to use the rolling averages to make sense of the data trends.

?

?

Leave A Comment