The market’s reaction to today’s FOMC Minutes was, to some, a little odd given the “December is on” hawkish narrative being sold to the public. Stocks rallied, longer-dated bonds rallied, gold managed gains, and the US Dollar sold off… not exactly the reaction one would expect from a ‘hawkish’ Fed statement. But there is one thing that would explain those moves… and it appears Goldman Sachs (GS) found it buried deep inside the 12 pages of Minutes…

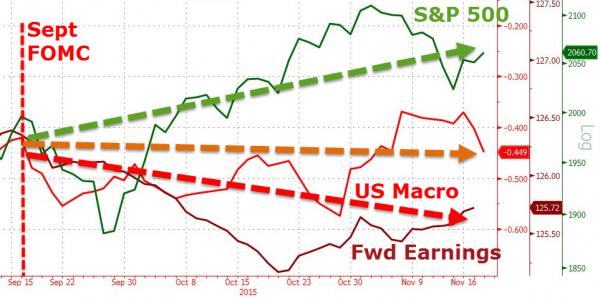

First, we know that macro and micro data had deteriorated notably from the September meeting to the October meeting…

Second, the reaction across asset classes was ‘odd’ – Bonds and Stocks bid, Dollar down and gold up (and crude up)…

So, what would create that kind of market response? We’ll let Goldman Sachs explain…

Leave A Comment