Bad news is good news again…

US Macro Surprises continue to disappoint…

And to be clear – all the gains in macro data have been ‘soft’ survey gains with ‘hard’ real data completely unchanged…

But bad news is great news and stocks had their best day of the year… Dow back above 20,000…

Stocks managed to scramble back to green on the week (Dow and Trannies red)…Small Caps squeezed to best of the week

On another big short squeeze…

VIX was crushed back to a 10 handle – after all it was a payrolls day and you always buy the fucking payrolls day dip…

Led by banks surging on Dodd-Frank repeal executive orders…

Goldman and JPMorgan accounted for half of The Dow’s gains today.

But it was an ugly week for FANG stocks…

And Energy stocks were the worst on the week…

Weak jobs data was trumped by Fed speak today to ramp yields back higher (30Y notable underperformer)…

The 2s30s Treasury yield curve steepened dramatically this week (post-Fed, post-payrolls) to its steepest since December…

But as we noted earlier, real yields have erased all the trumpflation gains…

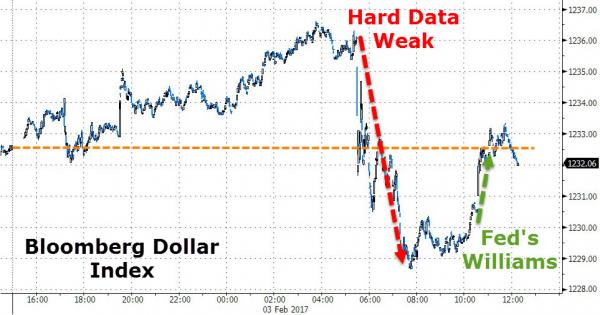

The USD Index fell for the 6th week in a row (every week in 2017) – and this week was the worst for the greenback since July 29th… falling to 2-month lows

The USD Index rallied back into the green briefly today thanks to a comment from The Fed’s Williams but ended lower…

As the dollar dropped on the week, Bitcoin rallied during China’s Golden Week… back above $1000.

Leave A Comment