Most realize something is broken in the current economy – and it is aggravating to listen to the litany of “information” pumped out in the media. The Fed continues to talk up the economy and continue to dangle the prospect of rate increases which suggests an almost healed and improving economy. Seems everything is getting rosy, and the only reason the economy is not doing better is because of the politicians as they are either spending too much or too little – or there is too much regulation.

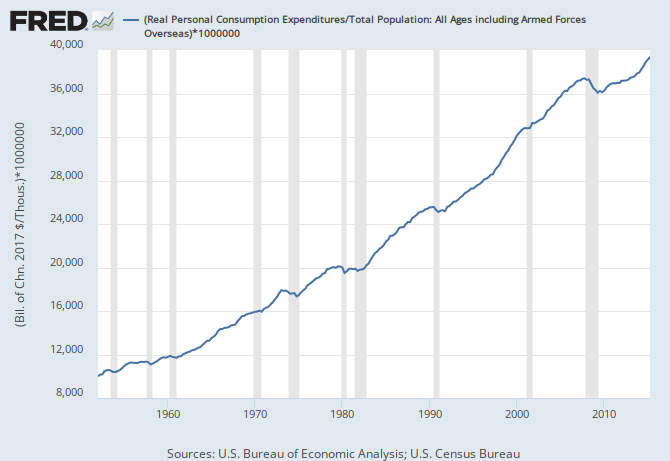

And to listen to headlines – the consumer has returned to the consumption trough. The per capita consumer spending continues to grow.

But unfortunately, this inflation adjusted picture distorts consumer spending. Literally half of consumer spending at the beginning of the Great Recession was on food and shelter, both now growing much faster than the inflation adjustments. Basically, Joe Sixpack, who was spending every penny on food and shelter at the beginning of the Great Recession, actually has less to spend in real terms on food and shelter – and likely little on anything else.

Note in the graph below, the inflation adjustment was removed from real median income so that it can be indexed against the growth of the CPI.

The point being made here is that the median consumer has yet to see an economic recovery. According to a study by the National Employment Law Project:

In summary, we find that real wage declines were greatest for the lowest-wage occupations. In the bottom quintile, restaurant cooks and food preparation workers experienced wage declines well in excess of the average for all bottom-quintile occupations and the entire occupational distribution. Real median wages fell by 5.0 percent or more in six of the ten occupations with the greatest projected job growth by 2022. Moreover, five of the ten highest-growth jobs were at the bottom of the occupational distribution in 2014, suggesting a future of continued imbalance.

Leave A Comment