Cabot Oil & Gas (COG) is a stock we have been covering for quite some time. Recently, the company posted its Q4 results, which was impacted heavily by movements in gas and oil prices. In this column, movements in the price of natural gas and oil, the performance of the company in Q4 and for year 2017, and offer our projections for 2018.

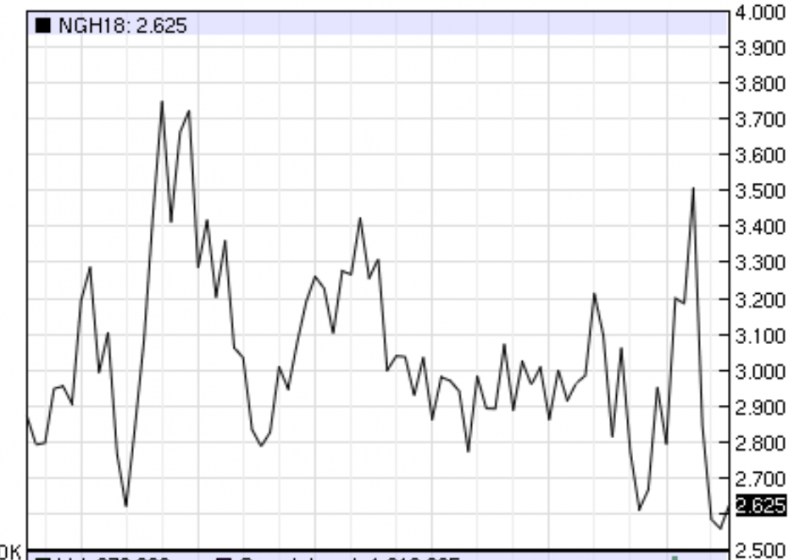

Movement in natural gas and oil prices

Take a look at the movement at oil and natural gas prices, respectively, for 2017:

Oil price in the last 18 months

Source: NASDAQ

Natural gas-

As you can see, the volatility in the prices of these commodities had moved the stock as well in 2017:

Source: Yahoo Finance

As you can see there is a correlation in the share price movement and that of oil and natural gas. Keep the movement in oil and gas prices in mind as we discuss performance of the company.

Q4 2017 performance

Let us first start with performance in Q4. Production matters. Fourth-quarter 2017 equivalent production was 172.6 billion cubic feet equivalents or Bcfe, consisting of 164.4 billion cubic feet (Bcf) of natural gas, 1,238.0 thousand barrels (Mbbls) of crude oil and condensate, and 131.5 Mbbls of natural gas liquids (NGLs). Cabot’s equivalent production increased four percent sequentially compared to the third-quarter. Natural gas production however disappointed us. It came in at the lower end of our expectations because of delayed in-service dates for two new third-party compressor stations. This less than expected production weighed slightly on our expectations for earnings, although price realizations were strong.

Fourth-quarter 2017 natural gas price realizations, including the impact of derivatives, were $2.18 per Mcf, a 12 percent improvement compared to the prior-year period. Excluding the impact of derivatives, fourth-quarter 2017 natural gas price realizations were $2.15 per Mcf, representing a $0.78 discount to NYMEX settlement prices. Fourth-quarter 2017 oil price realizations, including the impact of derivatives, were $54.54 per Bbl, an increase of 27 percent compared to the prior-year period. NGL price realizations were $23.51 per Bbl, an increase of 70 percent compared to the prior-year period. Fourth-quarter 2017 operating expenses (including financing) decreased to $2.01 per Mcfe, a two percent improvement compared to the prior-year period. This led to a strong financial result when combined with production.

Leave A Comment