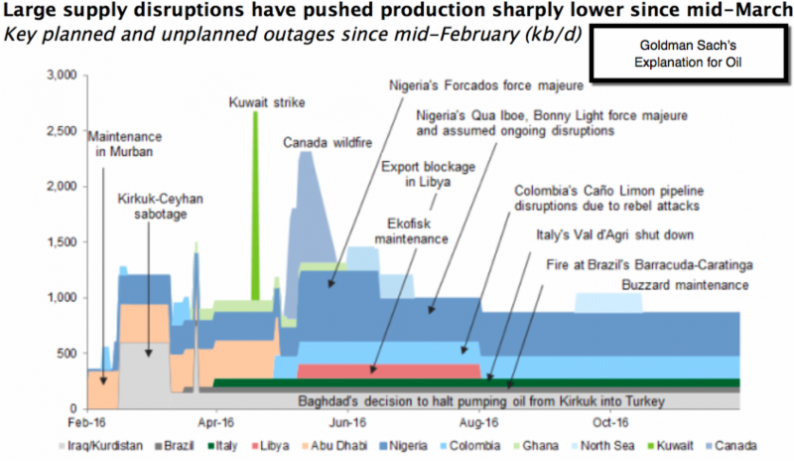

A perfect rouge wave took this market up out-of-the-box Monday; and that of course ignored any fundamentals like poor Chinese or NY Empire State ‘reality check’ economic data. All it took (perfectly announced) was Buffett apparently on the buy side of Icahn’s Apple (AAPL) sale (Buffett often buys high and it looks like he did with purchases completed by the end of March, though announced now when it was technically helpful to the overall market); and of course Goldman reversing their view yet again, and now speaking bullishly about Oil after recent run-ups.

It’s notable that nobody seems to have noticed that the rebound came precisely where needed; the edge of the technical support above what we’ve termed a ‘precipice’; trying to further forestall what we think is forthcoming, one way or another over time.

Daily action in a nominal Expiration week might not maintain strength beyond hours just ahead; because so much of this is based on oil stocks and just Apple; and little else.

We’re simply holding short June S&P from 2104 and the rebound off the edge of a breakdown, occasioned by the stories trotted-out is pretty self-evident. This is a dangerous market, both fragile and tenacious; and just trying to literally sort of ‘hold the line’.

Leave A Comment