The US divergence in growth, monetary policy and in trade drives markets today. This isn’t that different than yesterday or the summer overall, but the isolationism of US policy on trade is seen as the key driver for pain abroad and indifference at home. The sharp bounce in US Manufacturing ISM to 14-year highs highlights this point. Isolationism isn’t new to the US but many see that as ancient history and beg for a return to the old world order. The relentless moves in EM and rise in the USD reflect the capital flows to the US and leave many investors nervous waiting for a mean reversion trade in US assets. The focus today is on Canada with the Bank of Canada expected to stay at 1.5% while the US/Canada trade talk continue and the US/Canada trade statistics are both released. While everyone but Trump and Trudeau want a deal fast, the risk of failure remains. The Mexico agreement brought relief last week but that didn’t last long. The view of US isolation working for more than a few months requires Canada and Mexico deals.

The USD also reflects the doubts abroad with Europe shifting from Italy to Greece again today. While a rally in Italy is usually a sign for relief in Europe it’s not working today – Deputy PM Salvini said the budget deficit would be around 2% with the flat tax plans postponed for now but a reduction in pension age and basic income plans instead. Early ECB Benoit Coeure warned that Greek banks’ capital is lower than elsewhere in Europe, consisting partly of deferred tax assets, and there is still a large amount of non-performing exposures (NPE) as a legacy of the crisis. The ability to extend and pretend on debt both in Italy and Greece requires growth and that is the crux of the issue today as the Service PMI reports were weaker in China, weaker in Italy and not good enough to drive up hopes for rate normalization to match the FOMC. Even good growth as shown from the Australian GDP today isn’t sufficient to counter trade worries going forward. Markets are fickle and right now, they are obsessed with isolationism working making the USD bid hold, while risk moods focus on the new EM punching bag of ZAR after yesterday’s weaker GDP confirms its recession.

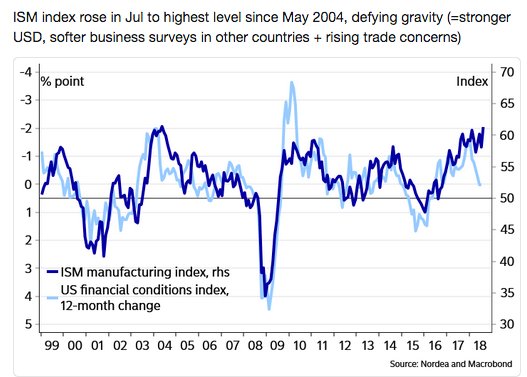

Question for the Day:Does the USD matter to the US economy? Since the US is mostly a closed economy with just 13% or so of the business exposed to trade, most economists would downplay the role of the USD in the short term as a key driver for economic outlooks. However, the stronger USD has been blamed in 2016 for some of the slower recovery and growth and, of late, Trump tweets hightlight the point about higher rates and stronger USD being a headwind to his goals of a 4% GDP. The correlation of the stronger USD to the higher S&P500 has been one of the key topics for regime shift thinking about the US economy and just how exposed the US equity market is to global pains. The disconnect between the USD and manufacturing is another notable part of the picture as US trade competitiveness has been traditionally part of the story. One way the US Fed responds to the USD is by watching financial conditions and there effect on business confidence and growth. So far this break in tighter conditions and higher ISM holds.

What Happened?

Leave A Comment