Rocky Road is more than an ice cream flavor, as numerous potholes threaten the lateral stability of a seemingly-rangebound market at a relatively high level.

The market’s staggering January decline and subsequent February rebound did indeed start running into trouble around the ‘Ides of March’; then shuffled without resolution to this very moment (off the rebound highs but not dramatically, yet). I was not surprised; in fact our forecasts (while not exciting, were generally correct over these two weeks) called the sell-the-news (or comments) on the FOMC as well as the Quarterly Expiration, and then suspected choppy ‘irresolute’ behavior both last week, and even into this week, with the actual Quarter’s-end coming.

That doesn’t mean this ‘relative’ calm won’t come to an earlier end. Especially as everyone will be focused on Chair Yellen’s remarks Tuesday; and Bill Dudley’s, New York Fed President, later in the week. Fed Presidents have confused lots of the thinking among those strategists who believe nothing but monetary policy matters; and for several years that has been a major influencing factor (always is but the ‘control’ central banks here and abroad have seems to be waning).

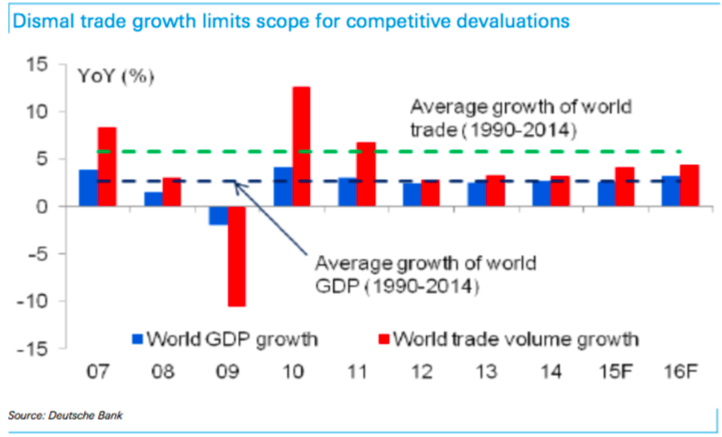

Technically, the market is encountering more than headwinds; it’s contemplating how earnings might actually matter in the context of slow (or just sloppy) global economic activity, as well as realization that GDP (again lowered today by the Atlanta Now measure, which was just lowered days ago). Growth measured by spending has simply evaporated with revisions seen now; and markets fight this by hoping that all we need is more dovish talk by the Fed Chair. If we get that (if so she will be in opposition to those who contradicted her last week; or today a Dallas Fed head who reinforced her), you might get an intraweek rally; but care should be taken; as such a move should be viewed as a ‘sell the news’ Fed yak yet-again. Last time she lifted the market for a few hours; this time maybe less.

Leave A Comment