We begin with the energy markets where the gradual declines in US oil output continue.

Source: EIA

This is the weekly US crude production compared with the previous year.

Let’s continue with several other developments in the energy markets.

1. US oil imports are no longer declining.

Source: EIA

2. Crude oil inventories continue to build. Here is oil in storage at Cushing, OK (the WTI settlement hub)

3. Gasoline inventories on the other hand declined more than forecast. This chart shows barrels as well as days of supply.

Gasoline futures jumped 6% in response.

Source: barchart

4. Crude oil also rallied on the back of lower gasoline inventories and was up 5% on the day.

Source: barchart

5. Speaking of inventories, US fuel ethanol in storage hit a record.

Related to the above, we’ve had quite a rally in the Canadian dollar on the back of firmer crude prices.

Source: barchart

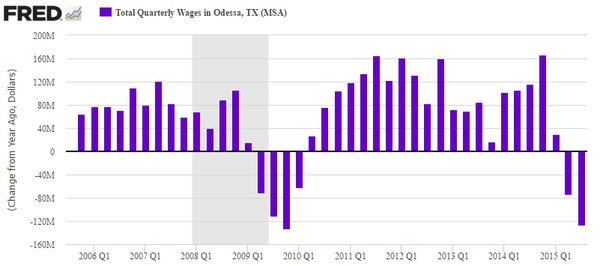

The weakness in crude oil over the past year is taking its toll on some communities. Here is the year-over-year change in quarterly wages in Midland, TX (Permian Basin) and Odessa, TX. These figures include the loss of hours/overtime as well as some layoffs.

Turning to New Zealand, the nation’s central bank (RBNZ) unexpectedly cut rates and signaled there may be more to come. Global downside risks were cited. The kiwi dollar fell sharply in response.

Source: barchart

And here is New Zealand’s 2-year government note yield.

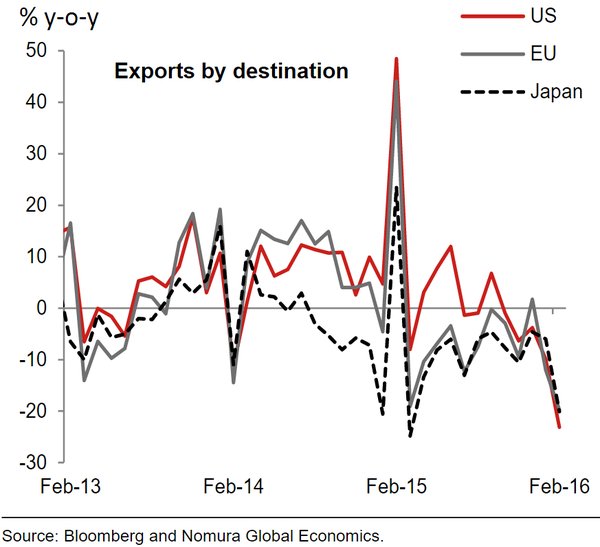

The chart below shows China’s exports by destination. It seems that the exports decline (discussed over the past couple of days) was quite broad. It remains to be seen how much of this decline was due to the New Year holidays.

Source: Nomura

Speaking of New Year’s celebrations, China’s CPI came in above consensus on higher food prices.

Indeed, China’s food CPI (YoY) spiked. This was driven by elevated New Year’s holiday prices (it is quite difficult to make seasonal adjustments to compare similar periods on a year-over-year basis around this time of the year.)

Leave A Comment