Greetings,

We begin with the United States where some key Fed officials are talking about 2-3 interest rate hikes this year.

Source: Reuters

Short-term treasuries, Fed Funds futures declined in response to these comments. Fresh US economic data (discussed below) added to the rate hike fears.

Source: @barchart

Source: @barchart

The futures-implied probability of rate hikes in 2016 yesterday vs. today is shown below. The probability of a June hike rose from 4% to 15% between Monday and Tuesday.

Source: @SoberLook

This is a good segue into the Daily Shot Fed policy survey results (thanks everyone for participating – we had close to 1k responses). Here are the two questions. The results are a bit more dovish than the sell-side economists’ forecasts and similar to the latest futures-based probabilities.

The treasury curve flattened further in response to the Fed officials’ comments. The market is pricing in tighter financial conditions as a result of a somewhat more aggressive tightening cycle.

Source: ?@SoberLook

It was interesting to see that gold remains resilient in spite of the threats of early rate hikes. Some are suggesting that the Fed officials are jawboning in order to curb some of the speculative activity in risk assets. However, this could lead to a loss of credibility if the FOMC doesn’t deliver another hike soon.

Source: @barchart

One of the data points that had the latest Fed comments resonate with the markets was this month-over-month CPI pop. The equity markets retreated sharply in response.

Below are a few other US economic reports..

1. The US “sticky” CPI levels off at around 2.5% – which is a bit higher than the Fed’s “target”.

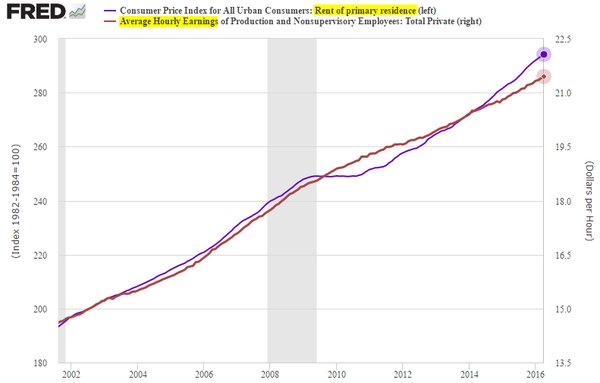

2. US rental costs continue to outpace wages.

Source: @SoberLook

4. US industrial production and capacity utilization exceeded forecasts, which also gives the FOMC hawks some ammunition.

5. The next chart shows 5-or-more-unit residential structures (apartments) currently under construction in the US.

6. The final US chart shows the Beveridge Curve (discussed here multiple times) broken out between long- and short-term unemployment. It’s interesting that the dislocation only applies to those unemployed 27 weeks or longer (those who lack the skills/experience currently in demand).

Leave A Comment