Greetings,

Once again we begin with the global bond rout. While there is some debate about the reasons for this correction, we had seen this movie before in 2015. Of course, bond valuations were not as stretched back then and equities weren’t correlated to bonds as they are now. As discussed yesterday, the value of long-term treasuries as a hedging tool for stock portfolios is now in question. Is the market, therefore, questioning the (negative) Treasury term premium?

Source: NY Fed

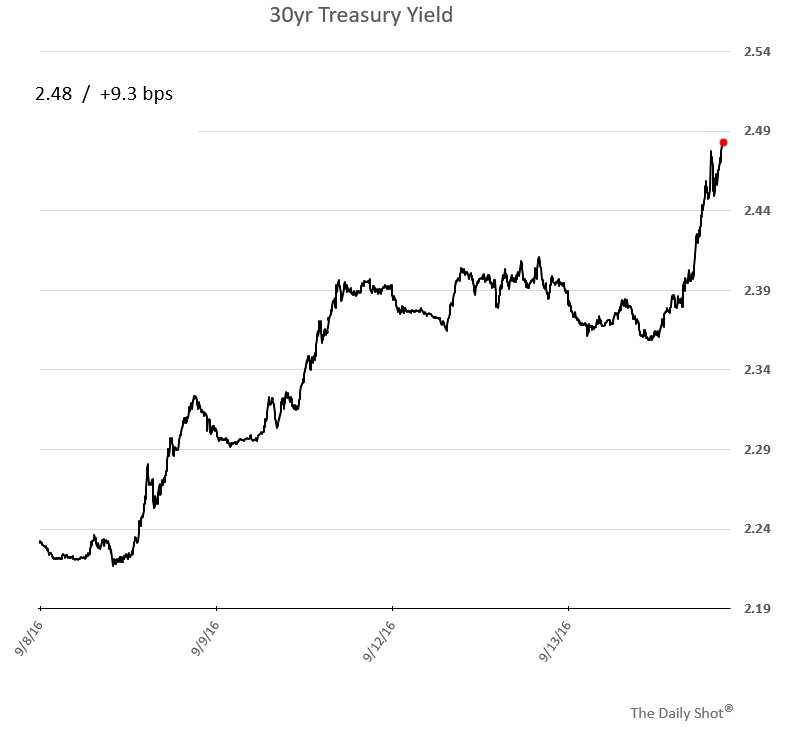

1. Here is the long bond yield over the past 4 days as investors cut durations. This past week saw a fairly sharp steepening in the yield curve.

2. As before, the sell-off is global in nature. Here is the Canadian 30yr government bond yield – these bonds are down for the 4th day in a row.

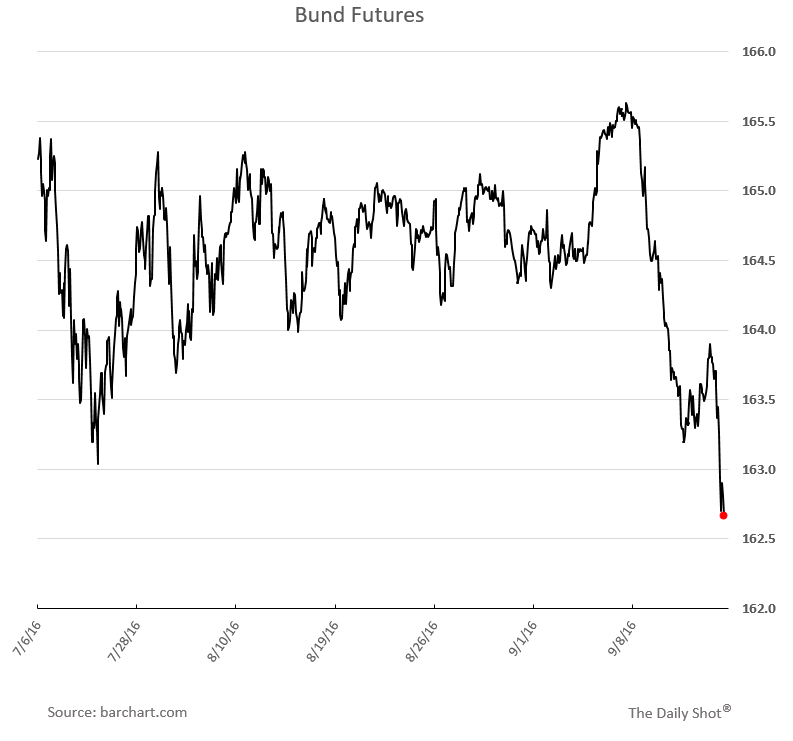

3. Bund futures take another leg down.

What’s the over-under of the 10yr Bund yield being back below zero by year-end?

4. The Australian bond rally was great while it lasted.

5. This story tells of a potential event last week that marked the top on global bonds. For now.

Source: Bloomberg.com

Here we go again – the equity market selloff resumes.

Source: barchart.com

The latest Merrill Lynch client survey shows that investors view long-term rates as having the greatest impact on stock prices – which is what we are witnessing now. They are no longer as concerned about oil.

Source: BofAML, @NickatFP

Nonetheless, the 3% drop in WTI crude (below $45/bbl again) didn’t help stock prices on Tuesday.

Source: ?barchart.com

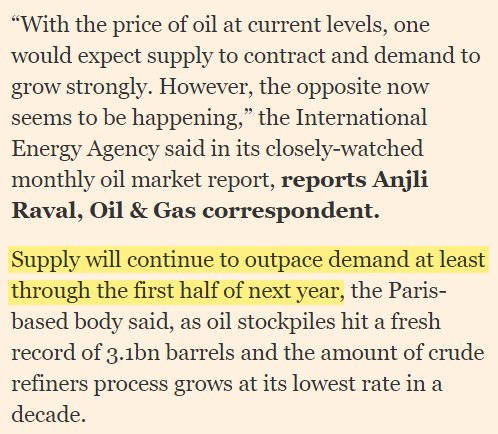

Why is oil under pressure again? The latest report from IEA suggests that the market will still be oversupplied in the first half of 2017. This report was a change in the Paris-based organization’s forecast.

Source: @FT

Source: Bloomberg.com

1. In other equity market developments, the trading volume in volatility ETFs spikes. This has less to do with investors trying to buy protection and more with speculative accounts unwinding short vol trades. For those who are hearing about this for the first time, take a look at the comment on VIX futures in the 8/16 Daily Shot.

Leave A Comment