The news cycle as a whole was somewhat slow this week, as is somewhat usual for the week leading up to the winter holidays. With that said, the last two weeks of the trading year are oftentimes subject to what is known as the “Santa Claus Effect.” Investopedia defines this phenomenon thusly,

“A Santa Claus rally is a surge in the price of stocks that often occurs in the last week of December through the first two trading days in January. There are numerous explanations for the Santa Claus Rally phenomenon, including tax considerations, happiness around Wall Street, people investing their Christmas bonuses and the fact that pessimists are usually on vacation this week.”

While it is certainly true that this effect will be most prevalent during the shortened trading week of December 26, it does occasionally start early so we may have seen some of the impact of it during this week. It may not have affected the offshore drilling sector as strongly as some other sectors however as the offshore drilling sector is still widely perceived to be fraught with risk, despite that fact that all the risk has been priced into the stocks for quite some time now and the industry has begun to recover. As usual, this weekly report will look at the price action of six representative stocks to serve as a proxy for the industry as a whole.

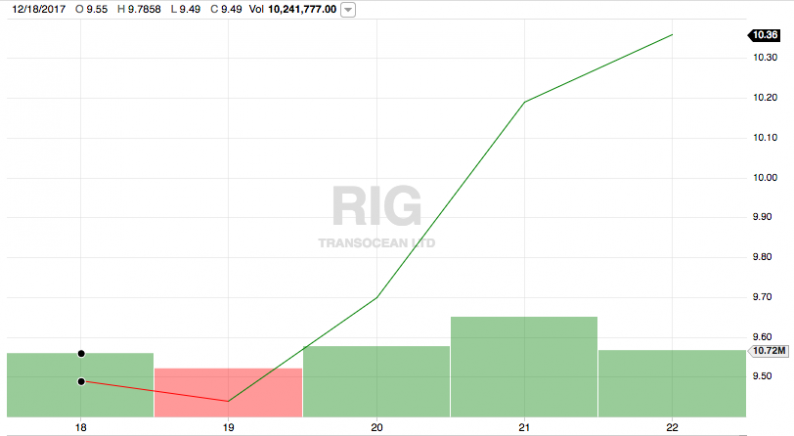

Transocean (RIG)

On Monday, December 18, 2017, Transocean opened at $9.55 per share. The stock declined slightly on Tuesday, December 19 then rallied and increased in price for the remainder of the week, closing at $10.36 per share. This gives the stock an 8.48% gain over the week.

Source: Fidelity Investments

Transocean’s stock price was quite volatile over the past two weeks. It declined quite sharply during the week of December 11, as was discussed during last week’s edition of this report, and then increased sharply this week. Overall, the stock gained 4.54% during the past two weeks. Traders may have liked the overall performance as well due to the volatility.

Leave A Comment