The last two weeks of the year are often interesting for the stock market as it oftentimes experiences what is known as the “Santa Claus effect.” The Santa Claus effect, in short, refers to the strong gains that the market experiences during these weeks as a result of employees investing their Christmas bonuses, portfolio rotation for tax purposes en masse, and mutual funds buying to enable the fund managers to achieve their investment objectives and maximize reported gains. As a result, we can expect the oil and gas industry to be affected by this effect. Let us have a look at six major companies in the industry to see if this was indeed the case.

ExxonMobil (XOM)

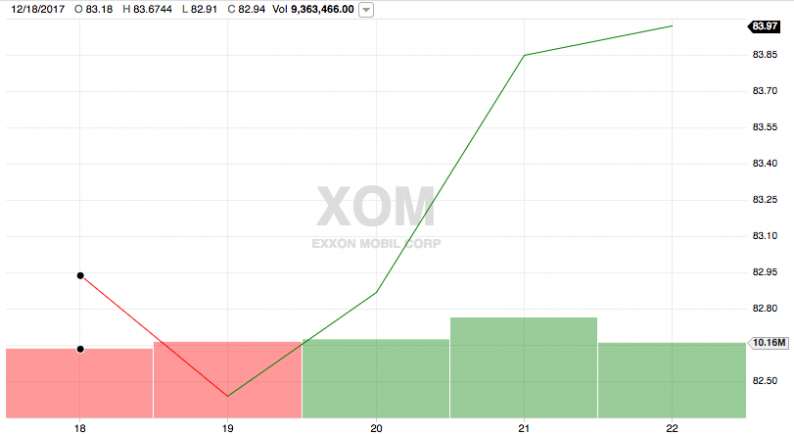

ExxonMobil delivered a gain last week, following a loss on Tuesday. The company opened the week of December 18 at $83.18 per share and closed the week at $83.97 per share. This gives the stock an overall return of 0.95% over the week.

Source: Fidelity Investments

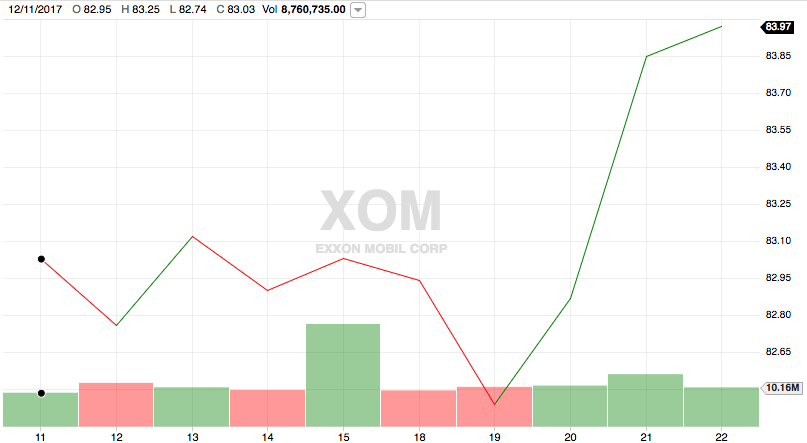

The stock’s two-week performance was also quite impressive, posting a fairly substantial gain over the period, although it had some volatility over the week of December 11 – December 15. However, it went from $82.95 to $83.97 per share over the two-week period for a gain of $1.02, which works out to 1.23%. Shareholders should be relatively pleased with this gain while traders undoubtedly appreciate the volatility.

Source: Fidelity Investments

On Monday, December 18, ExxonMobil and BHP (BHP) announced that they will end their joint marketing natural gas venture in Australia. This was due to governmental concerns that the joint venture is large enough to be unfairly stifling competition as it is by far the largest natural gas producer in the Southern States. It is uncertain exactly what effect this will have on ExxonMobil’s profits beginning in 2019 when the arrangement takes effect as the company will conceivably still be marketing the same quantity of natural gas, it will just be doing it independently of BHP Billiton and competing against its former partner.

Chevron (CVX)

Chevron also delivered a gain to investors last week with much more stability than ExxonMobil saw. This is because it gained slightly on Tuesday, December 19 instead of delivering a loss. The stock opened the week at $119.92 per share and closed the week at $124.98 per share. This gives the stock an impressive gain of 4.22% over the week.

Leave A Comment