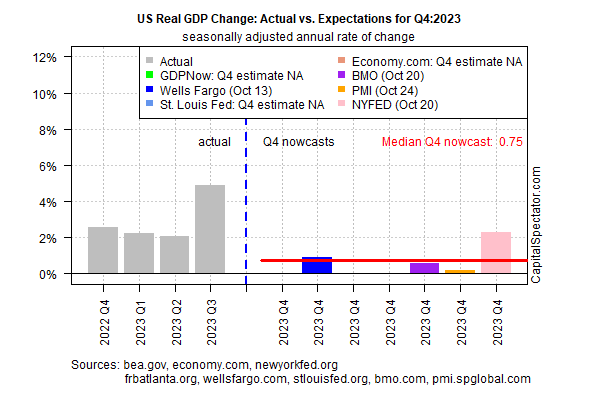

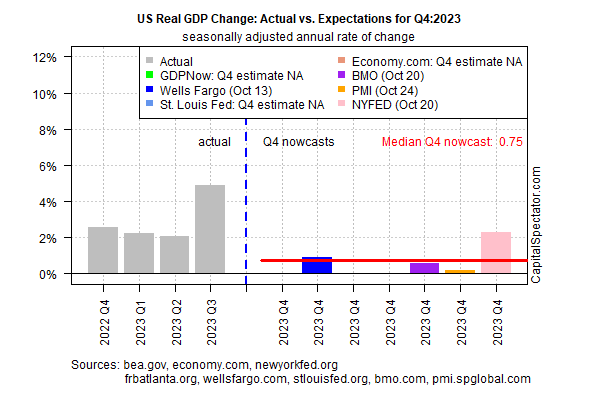

Yesterday’s blowout rise for US economic growth in the third quarter delivered an upside surprise, especially for analysts who remain all in with forecasting recession. But perhaps the warnings will finally find traction via the current run of softer Q4 nowcasts.Before focusing on this year’s outlook for the final quarter, let’s start with Q3’s 4.9% increase in GDP, which is more than double Q2 gain. The rise was an upside surprise for most estimates, including CapitalSpectator.com’s final 3.8% nowcast for Q3.For the dwindling band of analysts who’ve been warning for much of the year that a recession is near, yesterday’s economic data is a shock that should serve as a wake-up call that it’s time to revise their models (or narrative arcs). Yet some are simply doubling-down and forecasting that recession risk is still high, albeit delayed… again. Eventually the pessimism will be right, much as a broken watch offers the correct time twice a day.Perhaps the failed recession forecasts will hit pay dirt for Q4. The initial guesstimate is a weak 0.8% increase – a world below Q3’s gain, based on the median estimate for sources compiled by CapitalSpectator.com. (Note: three of the seven estimates in the chart below don’t currently offer Q4 nowcasts.)

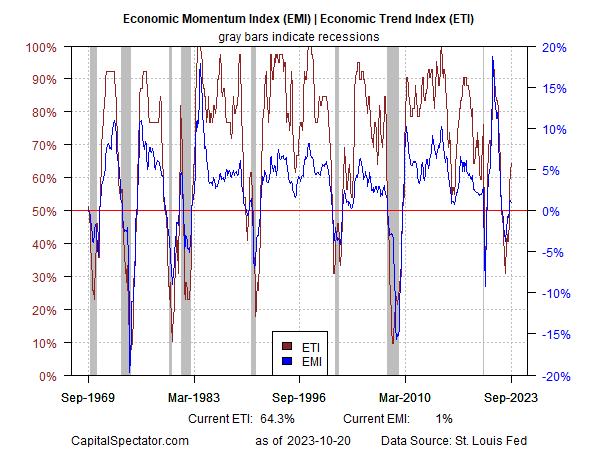

The obvious caveats: it’s still early in the current quarter and so the current median nowcast should be viewed with a high degree of caution.Yet by some accounts the possibility that the economy may finally crack suggests that trouble is lurking once again.“It would be very surprising if consumption growth remains this strong in the fourth quarter,” says Andrew Hunter, deputy chief U.S. economist at Capital Economics. “There’s room for higher rates and various other headwinds to start taking a bit more of a toll.” The Conference Board advises that “while the prospects for a soft-landing for the US economy have improved, our base case forecast still calls for two quarters of contraction in early 2024.”Meanwhile, a set of proprietary macro indicators updated weekly in The US Business Cycle Risk Report continue to reflect low recession risk. Both indicators in the chart below continue to print above their respective tipping points that signal recession following last year’s false warning that quickly reversed. (For a review of this event, see this post.)

Near-term estimates for ETI and EMI through November suggest the expansion will persist. Surely there’s another recession approaching, but the data writ large strongly indicate that the next down is (still) not on the near-term horizon. When and if that changes, as it will at some point, the telltale signs will show up in the numbers. Meanwhile, flirting with narratives and misguided analytical efforts to see demons around every corner will continue to yield the usual results.More By This Author:Large-Cap Stocks Continue To Lead US Equity Factors In 2023U.S. Soft Landing Odds Rise As Q3 GDP Nowcast Ticks UpMarket Sentiment Suggests Fed Funds Rate Has Peaked… Again

Surely there’s another recession approaching, but the data writ large strongly indicate that the next down is (still) not on the near-term horizon. When and if that changes, as it will at some point, the telltale signs will show up in the numbers. Meanwhile, flirting with narratives and misguided analytical efforts to see demons around every corner will continue to yield the usual results.More By This Author:Large-Cap Stocks Continue To Lead US Equity Factors In 2023U.S. Soft Landing Odds Rise As Q3 GDP Nowcast Ticks UpMarket Sentiment Suggests Fed Funds Rate Has Peaked… Again

Leave A Comment