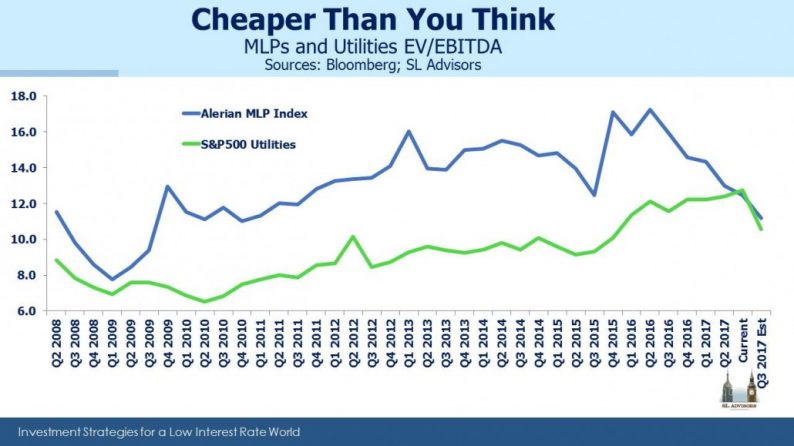

Why aren’t MLPs performing better given the fundamentals? On valuation, they should be compelling. Using EV/EBITDA (Enterprise Value /Earnings Before Interest, Taxes, Depreciation and Amortization), they are virtually on top of utilities, a point not reached either in 2008 or 2016.

Typically, MLPs are valued at a higher multiple. Although like utilities, they depreciate their assets, unlike power plants, pipelines buried underground typically appreciate, since their cashflows grow. They also have more flexibility in their customer base, since a pipeline can move hydrocarbons from anywhere that’s connected by the network. The customer base of a utility is geographically fixed. And EBITDA generated by a utility is subject to taxes, whereas MLPs don’t pay tax. For all of these reasons, EV/EBITDA multiples for MLPs are usually higher. Consequently, when relative valuations approached one another as they have twice briefly in the past decade, a sharp recovery in MLPs followed.

The yield on the Alerian MLP Index is currently 7.8%, 5.6% above the ten-year treasury and substantially wider than the 15 year average of 3.5%. Moreover, MLP debt is performing far better than their equities, suggesting no particular financial distress.

2Q17 earnings were largely uneventful, with the dramatic exception of Plains All American (PAGP) which warned of a likely distribution cut (see MLP Investors Learn About Logistics). Management teams report that business is fine, cashflows growing and product moving. At some point in the next year, we’re likely to see U.S. crude oil production exceed 10 Million Barrels per Day, a record last seen in November 1970. Yet MLPs fall when crude prices are weak and seem indifferent when they rise. What is going on?

MLP investors originally signed up for high, stable distributions with modest growth and not much excitement. The widely-hated K-1s provide a useful tax deferral for those willing to hand them off to an accountant. The tax benefit accumulates over time, creating a powerful incentive to delay selling which would make the tax bill come due. Some MLP investors really do hold forever, or at least their lifetimes, leaving their heirs to benefit from a stepped-up cost basis that wipes the tax slate clean. In a world of trigger-happy equity analysis with a relentless focus on the next few days or hours, MLP investors are what every company says they want: in for the long-term.

Leave A Comment