Sure, I am the guy with indicators called the 3 Amigos and in the future, the 4 Horsemen. I am the guy who for 17+ years has been making up catch phrases for indicators and market backdrops alike (ex. 30yr T bond Continuum, Armageddon ’08 and the Fiscal Cliff Kabuki Dance, etc.) entertaining, pissing off and confusing people, and maybe along the way doing some teaching too.

Currently, we have the happy-go-lucky Amigos (SPX vs. Gold, 10yr/30yr Yields & the Flattening Yield Curve) front and center as they ride toward their destinations, the end of the journey to which would begin to change the macro. We also have a supremely sensitive proprietary indicator being used in NFTRH to significantly fine-tune the process of interpreting changes to the current cycle. You’ve gotta come at the macro from as many rational angles as possible if you want to minimize its confusing aspects.

But the angle I want to come at it from today is linear and normal, having to do with standard economic data and inflation. Tomorrow is the climax to a week that was full of inputs, from the Trump SotU love-in to the FOMC punt, with a nod to increased inflation concern.

I thought that little hawkish tweak in inflation wording in yesterday’s FOMC release was pretty slick of Janet Yellen, as if something changed since the last meeting (NFTRH.com has been on the higher long-term yields theme for months now, after all, and Treasury yields – from 2s to 10s and lately, 30s – should drive Fed Funds policy). So Yellen gets to ride away with everything intact and a little ‘don’t say I didn’t tell you so’ marker about inflation for the record.

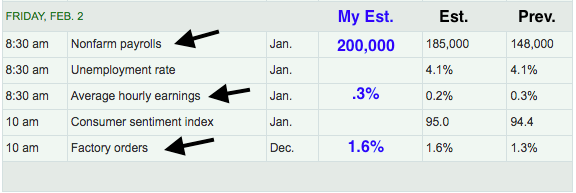

By way of MarketWatch (my markups) here is tomorrow’s data slate…

So where is the inflation-fueled economy at currently by the data most commonly used by conventional analysts and financial media? Well, aren’t my estimates just bright and cheery about December? Q4 was a strong end to a strong year. All of the stuff above is relatively backward looking. It’s the stuff that the media and by extension, the herd will focus upon. And they will as always be late.

Leave A Comment