TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Eden Rahim of Toronto-based Next Edge Capital has had his share of multibagger and grand-slam successes, and is one of the few mutual fund managers who feels comfortable investing in micro-cap biotech names side-by-side with billion-dollar biotech stocks. In this interview with The Life Sciences Report, Rahim describes a group of micro-, small- and mid-cap biotech names possessing powerful growth drivers that could perform even when the overall market is not so hot.

The Life Sciences Report: After China’s shares began selling off in early January, investors all over the globe began dumping shares of everything, especially healthcare and biotech. You have managed biotech portfolios since 1994, and you put on hedges so your downside is limited. How did you do during the downturn? Did it take you by surprise?

Eden Rahim: Admittedly, I did not see the intensity of the selling that began in January, compared to when stocks began to slide last August. I was nervous at that time and wrote options against 11 of the fund’s largest holdings. I also had a few hundred IBB (iShares Nasdaq Biotechnology Fund [IBB:NASDAQ]) and XLV (Health Care SPDR (ETF) [XLV:NYSE.Arca]) puts on the portfolio. When the market took that first leg down of 30%, the portfolio weathered the storm really well.

Traditionally, January and February have been a favorable season for biotech, so coming into this year I had small hedges in place, and my cash was only around 10% versus close to 20% back in August. This downturn really came as a surprise.

TLSR: What precipitated the selloff?

ER: It started when the U.S. Federal Reserve raised interest rates a quarter of a percent in mid-December. Rates were near zero, and that was the first hike in nine years. Personally, I would have thought that hike was fully priced into the market, but strangely, the market acted as if it was a complete surprise. Market breadth began to weaken.

Part of the market reaction might have been due to the rhetoric that this was going to be the first of many hikes. When that talk began, we saw the risk-off trade really come to fruition, so that any emerging market—any high-yield debt, any high-beta asset, even housing stocks—came under intense pressure. This included biotech. Biotech, having the longest duration of all asset classes, suffered the brunt of it.

TLSR: How do individual investors maneuver in these situations?

ER: Individual investors are as empowered as I am to hedge their portfolios. In the fund, we use options on the XLV and on the IBB. Investors can use these for protection in their own portfolios. For biotech, you can also sell (write) options against your positions. You can write one-month, out-of-the-money options, and once they go far out of the money, you can cover and rewrite another month. The individual investor is as empowered as a portfolio manager to do these things.

TLSR: Are you ever long the IBB ETF, or do you just use its options?

ER: The fund can be long the index, but generally is not because the portfolio is comprised of fairly high-beta stocks in the mid-cap area, where the fund is focused. If you look at the weighted volatility of the individual portfolio positions, they are roughly 70%, versus ~35% for the IBB. But the portfolio volatility is still less than the IBB’s because of the use of options to mitigate some of that unpredictability. That’s the advantage.

The fund generally uses the IBB options as a counter to the existing portfolio direction because, given the beta of the stocks held—primarily Phase 3 companies—in a market rally such as I think we might embark upon soon, they will have a beta of two or three times the IBB. I’m comfortable being there. Generally, the IBB is a hedge, but as your question implies, it doesn’t have to be. Never say never.

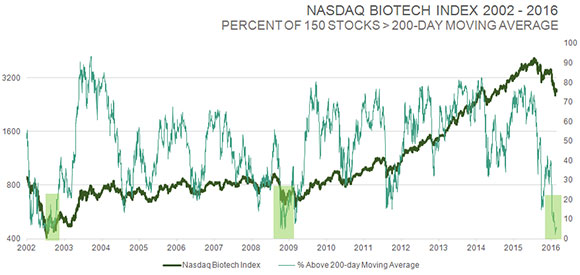

TLSR: You perform meticulous fundamental analysis on biotech stocks, but you are also an elf, as Louis Rukeyser used to call his technical analyst guests on Wall Street Week. I want you to put on your elf’s hat for a moment. You sent out an e-mail on Feb. 10 that included a chart showing the IBB index over a 15-year period. You highlighted the huge biotech rallies following periods when only 0–4% of biotech stocks in the IBB were above their 50-day moving averages. What percentage of biotech stocks in the IBB are above their 50-day moving averages today, and what does that bode for the future?

ER: Technical analysis is an important tool for biotech because of the extent to which shares and biotech indices oscillate between feast and famine. I look at a number of indicators.

Biotech has achieved a very rare oversold level, by many measures. Looking at one of those indicators, such as the 150 stocks in the NASDAQ Biotech Index, only 3% of those stocks were above their 50-day moving average when I sent out that e-mail. That’s the second lowest reading going back to 2001. It hit zero at the very bottom during the crash in 2008, but then again, every market class hit zero at that point. Now, ~6% of stocks in the IBB are above their 50-day moving average, and that’s probably going to go much higher because we are dealing with an elastic band that is stretched at the moment.

But there are other measures as well. The percentage of those same stocks above the 200-day moving average has dropped below 10% to the lowest reading in 14 years, at the bottom of the two-year bear market in 2002. A similar reading in 2008 occurred after the stock market was down more than 50%; the conditions were pretty extreme at that time. That’s the magnitude of extreme oversold readings you are seeing with biotech stocks right now.

TLSR: Having ~6% of stocks in the IBB above the 50-day moving average is a bullish signal from your point of view?

ER: Right. That elastic band could really snap hard off this low. Sometimes, when the market is selling a sector with impunity, you’re not sure where it ends, but usually it ends when you start to see off-the-chart readings like this, because they only happen once every six or seven years.

Furthermore, the NASDAQ biotech index has corrected back to its 200-week moving average for the first time since the bull market began in 2011. It has served as a good starting point for new bull markets four out of the past five times since 2002.

Leave A Comment