US equity futures in the green ahead of critical Senate debate on US tax reform and a much anticipated testimony from Yellen replacement Jerome Powell for Fed’s current policy approach. European stocks advance, led by oil and gas stocks after Shell fully restored its cash dividend and unveiled a bullish outlook. Asian shares slide despite the reappearance of the Chinese “National Team” which stabilized the SHCOMP selloff in the last hour. USD recovers gradually from overnight lows against G-10, pushing GBP/USD and EUR/USD to session lows, while oil and treasuries edged lower.

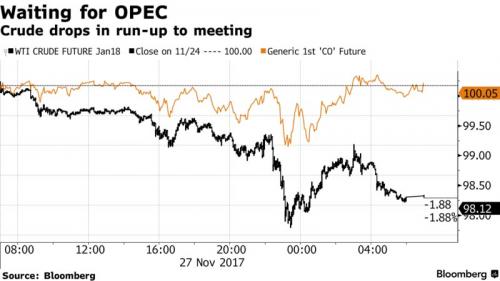

In a rerun of Monday’s overnight trading, it has been another choppy session without key catalysts to set market direction according to Bloomberg. While the dollar rebounded, commodity FX was pressured by a consistent grind lower in copper and oil futures, while reports of Russia not committing to OPEC cut extension coupled with a Goldman report warning the OPEC meeting this week may disappoint weighed on crude. U.S. equity futures approach yesterday’s highs in early trading while core fixed income product hold in a tight range, as peripheral EGB spreads are marginally tighter. The flattening Treasury curve pivots around 7Y sector before today’s auction.

After an early sell-off, European equities traded higher across the board (Eurostoxx 500 +0.4%) in what has been a relatively light session thus far in terms of macro newsflow. On a sector specific basis, energy names are the notable outperformers with oil & gas heavyweight Shell (+3.0%) top of the FTSE 100 after restoring its full cash dividend as it emerges from the crude-oil slump with investor sentiment spurred by the company lifting their guidance for free organic cash flow and the company’s intention to carry out at least $25bln in share buybacks between 2017 and 2020. Meanwhile, miners lagged as metal prices continued to slide while material names lag given the movements in metals markets during Asia-Pac trade which has subsequently capped gains in the mining-heavy FTSE100.

Most of Asia was in the red, with Hong Kong’s China Enterprises Index leading the losses. Shares drifted from decade highs as Chinese stocks stumbled for a second straight session, with confidence dented by rising bond yields as Beijing intensified a crackdown on risky financing, threatening to squeeze corporate profits. Additionally, Chinese shares traded in Hong Kong fell amid concerns the country’s regulators will limit the flow of mainland funds into the city’s stocks, while mainland equities rebounded after the National Team made a long-awaited reappearance. The MSCI Emerging Market index was up 0.2 percent

The CSI300 index has jumped 22 percent in 2017 so far, with the gains concentrated in a handful of large index-weighted stocks. “The question is whether further downside in Chinese mainland equities continues in the session ahead and will there be a spillover into Hong Kong and potentially even Japan, Korea and Australia?” asked Chris Weston, Melbourne-based chief strategist at IG Markets.

The yen reversed gains after a rally partly fueled by a Kyodo News report that Japan detected radio signals suggesting North Korea is preparing for a missile launch. 10yr JGBs were mildly supported at the open after gains in T-notes and as Japanese markets began on a cautious note, although upside was capped as sentiment briefly improved and after an uninspiring 40yr auction result.

The Bloomberg Dollar Spot Index swings between losses and gains as intraday traders dominate price action; leveraged accounts are waiting for Powell testimony and tax plan developments before adding positions according to Bloomberg.The USD Index recovered some lost ground after Monday’s slide, but remains heavy just under the 93.000 handle as bearish sentiment persist (mostly over US tax reform uncertainty, ‘lowflation’ and Fed policy implications beyond December). EUR back to pivoting the 1.1900 level vs the USD, but underpinned on pull-backs below the big figure with bulls still positioned for a test of 1.1961 ahead of 1.2000 and 1.2033 before September 8’s YTD peak at 1.2092. Elsewhere, sterling drifted and Ireland’s bonds rose despite controversy engulfing the Irish government and threatening Brexit talks escalated.

The BoE said none of Britain’s major lenders would need to raise extra capital if the country crashed out of the European Union, the first time it had come to such a conclusion since it started stress-testing banks in 2014. But the chances of a hard Brexit were increased by the prospect of a snap election in Ireland which could be called as early as Tuesday, and which would complicate a key Brexit summit next month.

Euro zone government bond yields were pinned to recent lows as the Irish government teetered, with 10-year German yields – the regional benchmark – dropping to 0.33%, barely 2 basis points of the November lows.“If we have snap elections and then if a Brexit deal is in jeopardy then it will have a major impact,” said DZ Bank analyst Sebastian Fellechner. “It could lead to a risk-off environment and be a disruptive factor in this very calm market.”

The yield on 10-year Treasuries was unchanged at 2.33% while the UST yield curve flattens.

On the commodities front, copper and nickel led industrial metals lower as weakening Chinese macro data and slowing home sales increase concern about the outlook for demand in the world’s top user. WTI was down 55 cents at $57.56 amid uncertainty over a possible extension of output cuts by major crude producers and expectations of higher supply as the Keystone pipeline restarts. Brent crude futures were down 54 cents to $63.30. Spot gold inched lower to $1,293.11.

Today, investors will turn their focus to the U.S. where the Fed Chair nominee Jerome Powell faces his Senate confirmation hearing in Washington. In a statement to the Senate Banking Committee ahead of the meeting, he signaled broad support for how the Fed operates, regulates and guides the economy.

“His opening comments support current market expectations that his appointment as Fed Chair is likely to maintain monetary policy continuity. The Fed’s recent comments have signaled more concern over persistently low inflation, which has been weighing on the US dollar,” wrote MFUG currency analyst Lee Hardman.

Leave A Comment