Things are getting ugly for FMC Technologies FTI. The company missed Q3 revenue estimates by a country mile. Revenue of $1.5 billion was 7% below the $1.7 billion analysts were expecting. The stock is down about 7% post-earnings. I had the following takeaways on the stock:

The Subsea Technologies Segment Is Getting Ugly

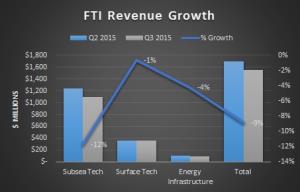

Total revenue was off 9% sequentially. The Subsea Tech segment (71% of revenue) was off 12% while Surface Technology was down 1%.

Source: Shock Exchange

As the Subsea Tech segment goes, so goes the company. What gave me pause was that in Q2 the company announced workforce reductions in Subsea which signaled orders could be slowing. This quarter longs’ fears were confirmed as revenue fell 12% sequentially. The performance also seemed to confirm industry studies that subsea equipment orders were drying up.

Vis-a-vis last quarter, Q3 Subsea Tech revenue also was negatively impacted by $155 million due to the effects of foreign currency translation. Management believes 2016 orders could be on the same level as 2015 orders. It could not commit to firm estimates due to a lack of visibility pursuant clients’ capital budget plans. My impression is that management is in denial. When the spigot for subsea orders is turned on, it’s turned on for a while and vice versa. Given low oil prices, I believe the Subsea segment will weigh on FMC Technologies for a few more quarters.

EBITDA Margins In Focus

With the top line slowing, it appears FMC Technologies will have to follow the example of equipment vendors with heavy exposure to North American land drillers. Firms such as Halliburton HAL and Schlumberger SLB started reducing head count and cutting costs in Q1 amid the oil industry contraction. FMC Technologies’ EBITDA of $194 million was off 20% Q/Q as EBITDA margins fell from 15% to 14% in Q3.

The company does not expect the Surface Technology segment (provides completion equipment to land drillers) to recover next year. It plans head count reductions of $4 million to $6 million in this segment. Including $15 million in restructuring charges for Subsea Tech last quarter, that’s a lot of cost cutting. To maintain margins it may have to cut further. That said, FTI no longer sounds like growth stock yet its 15x earnings multiple suggests otherwise.

Leave A Comment