With last Friday’s “tech wreck” now a distant memory, this morning the “FOMC Drift” described FOMC Drift, which “guarantees” higher stock prices and a lower dollar heading into the Fed announcement is in full effect, with European and Asian stocks rising for a second day, led by rebounding tech shares, while S&P futures are modestly in the green and stocks on Wall Streets hit a record high overnight. And as the “FOMC Drift” also expected, the dollar has weakened for a third day with Treasuries rising, while oil fell after the latest IEA world forecast cut its global demand forecast while boosting output expectations.

The MSCI All-Country World index was up 0.1% and has remained stuck in a tight range this month. European shares headed for the highest in more than a week as companies including ASML and Hexagon (on M&A speculation) led the tech share revival in the region. The Stoxx Europe 600 Index gained 0.6%, building on a 0.6% increase the day before.

The British pound, which rose Tuesday for the first time since the U.K. election, traded sideways as pressure mounted for Theresa May to abandon a so-called hard Brexit. Oil resumed its decline as industry data showed U.S. crude stockpiles expanded and the International Energy Agency predicted new non-OPEC output would outstrip demand growth next year.

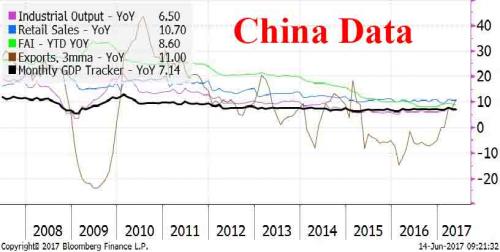

Sovereign yields drifted sideways inside narrow ranges with the Loonie rising for a fifth day in otherwise muted FX markets. The Nikkei was modestly higher while Shanghai Composite declines after China data dump (China May retail sales 10.7% vs 10.7% est; fixed investment 8.6% vs 8.8% est, industrial output 6.5% vs 6.4% est) was seen as mixed, with overall resilience in retail sales and industrial output offset by capex weakness, but Chinese equity markets fell on concerns about a crackdown on the insurance industry after Anbang’s chairman was “detained.”

The Shanghai Composite Index tumbled 0.7 percent and the CSI 300 Index dropped 1.3 percent, its biggest loss this year. The Hang Seng Index erased losses to add 0.1 percent and the Kospi Index in South Korea fell 0.1 percent. Japan’s Topix Index closed down 0.1 percent, while Australia’s S&P/ASX 200 Index climbed 1.1 percent to its highest since May 16. Also in China, money-market rates eased as PBOC injects a net 20 BN yuan with reverse repos and the 7-day repurchase rate fell 32 basis points from Tuesday’s one-month high, overnight CNH Hibor drops to lowest since February.

Also in China, we got the latest credit creation data which showed a modest beat in New Loan activity offset by a miss in Total Social Financing, however it was the M2 which unexpectedly rose by just 9.6%, below the 10.4% est. and the lowest on record. In a statement on its website, the PBOC said that the slower M2 growth may become “new normal” amid leverage cut, adding that the PBOC was seeking to balance delveraging and stable liquidity.

S&P 500 futures were little changed. The gauge added 0.5 percent Tuesday and the Nasdaq 100 climbed 0.8 percent, rebounding from its worst two-day drop of the year.

The pound slipped less than 0.1 percent to $1.2743 after it strengthened 0.8 percent Tuesday. The Canadian dollar rose 0.2 percent, gaining for a fifth day. The euro was little changed at 1.1210. The Bloomberg Dollar Spot Index fell 0.1 percent. The yen was also 0.1 percent weaker at 110.19 per dollar

In commodities, oil prices fell more than 1 percent, on the backfoot again on worries about US oversupply. Brent crude oil was down 45 cents a barrel at $48.27 while U.S. crude was 50 cents lower at $45.96. U.S. inventories climbed by 2.75 million barrels last week, the American Petroleum Institute was said to report. The latest IEA report stated that global oil supply rose by 585k b/d in May to 96.69mm b/d as both OPEC and non-OPEC countries produced more. Meanwhile 2017 world demand was revised to 97.8m b/d from 97.9m b/d. Gold rose 0.1 percent to $1,268.30 an ounce.Iron ore reverses early losses to climb 1.6%.

All eyes will now turn to the Federal Reserve. The widely expected quarter-point interest rate hike will take the Fed funds target rate above 1 percent for the first time since the immediate aftermath of the collapse of Lehman Brothers in 2008. The Fed is expected stick to previous guidance for another hike before year-end, while acknowledging that inflation is muted. The $4.5 trillion question will be what clues are given on the timetable and scale of eventual balance sheet reduction. Traders’ focus will be on signals on the frequency of further hikes and how the Fed plans to unwind its huge Treasury bond stockpile over the years ahead.

“Markets will probably mostly just trade sideways today in front of the Fed’s rate decision and press conference tonight,” John Cairns, a Johannesburg-based currency strategist at Rand Merchant Bank, said in a client note. “The range of issues that the bank has to cover and the market’s sensitivities to even the slightest changes suggests some market volatility after the event.”

Leave A Comment