Forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.05961

Opening: 1.06046

Chg. % Of the last day: +0.06

Daily range: 1.05946 – 1.06188

52-week range: 1.0366 – 1.1616

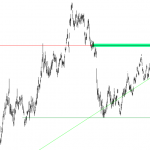

Yesterday’s positive statistics on the economic sentiment indexes from ZEW supported the demand for a single currency. The key trading range is still 1.05750-1.06400. The publication of important economic reports is not planned today. The attention is focused on geopolitical risks in the Middle East.

Indicators point to the bullish sentiment. The MACD histogram is in the positive zone and continues to rise.

Stochastic Oscillator is located in the neutral zone, %K is above %D, which also sends a signal to buy EUR/USD.

At 15:30 (GMT+3:00) the data on the export price and import price indices in the US.

Trading recommendations

Support levels: 1.05750

Resistance levels: 1.06400

We expect an increase in the EUR/USD currency pair. We recommend looking for entry points to the market for opening long positions. The movement is tending potentially to 1.06500-1.06750.

Forecast for the GBP/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.24136

Opening: 1.24904

Chg. % of the last day: +0.62

Daily range: 1.24800 – 1.24949

52-week range: 1.1986 – 1.5020

Yesterday, the pound rose against the US dollar by more than 80 points. This is due to the release of quite strong inflation data in the country. At the moment the GBP/USD currency is being traded near the round level of 1.25000. We expect statistics on the UK labor market.

The MACD histogram has fixed in the positive area, but below the signal line, which gives a weak signal to buy GBP/USD.

Stochastic Oscillator is in the neutral zone, %K line is above %D line, which indicates the growth of GBP/USD.

News line on the economy of Britain:

– average wage level with premiums (11:30 GMT+3:00);

– change in the number of claims for unemployment benefits (11:30 GMT+3:00);

– the unemployment rate (11:30 GMT+3:00);

– speech by the Head of the Bank of England Carney (11:30 GMT+3:00).

Leave A Comment