Inquiring minds might be interested in stats on French and Italian bank deposits and deposit guarantees.

Let’s start with a look at equity in FGDR, the French guarantee company vs. the amount of deposits according to ECB stats.

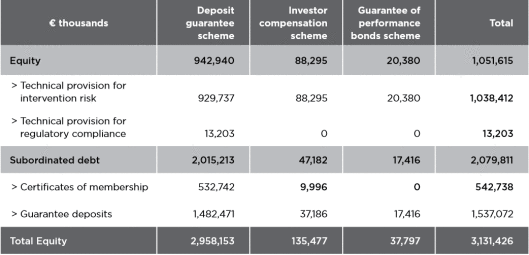

FGDR Equity

The above chart from page 25 of the FGDR Deposit Guarantee 2014 annual report.

The mechanism has about €3.13 billion equity as of December 2014.

French and Italian Bank Deposits

French bank deposits total €4,068 billion as of December 2015 according to theECB Euro Residents Deposit Report.

Not all of those deposits are covered by insurance. The guarantee is limited to the first €100,000.

Look at things this way: €3.13 billion would cover a mere 31,000 accounts of €100,000 each.

From the same report above, Italy has €2,395 in deposits.

Italy’s Guarantees

No doubt, you are now wondering how big Italy’s guarantee fund is.

So am I.

In fact I wonder if Italy and nine other eurozone contries have them at all, or if they do, what shape those deposit guarantee funds are in.

10 Eurozone Countries Cited for Noncompliance on Deposit Guarantees

Please consider this December 2015 European Commission Press Release on Deposit Schemes.

The European Commission has formally requested Belgium, Cyprus, Estonia, Greece, Italy, Luxembourg, Poland, Romania, Slovenia and Sweden to fully implement the Deposit Guarantee Schemes Directive (DGSD).

The European Commission has formally requested Belgium, Cyprus, Estonia, Greece, Italy, Luxembourg, Poland, Romania, Slovenia andSweden to fully implement the Deposit Guarantee Schemes‘ Directive (Directive 2014/49/EU, DGSD). This Directive, which builds upon the previous Directive 94/19/EC of 1994, improves the protection of deposits. Depositors will benefit from quicker pay-outs and a stronger safety net as more unified funding requirements will ensure that deposit guarantee schemes are pre-funded and will be able to fulfil their obligations towards depositors more efficiently. It is a step towards a fully-fledged Banking Union to create a safer and sounder financial sector in the wake of the financial crisis.

The deadline for transposing these rules into national law was 3 July 2015 (see MEMO/13/1176). However, 10 EU countries have failed to implement these rules into their national law. The Commission’s request takes the form of a reasoned opinion. If these Member States fail to comply within two months, the Commission may decide to refer them to the Court of Justice of the EU.

Leave A Comment