Has the market’s “melt-up” levitation finally ended? Of course, it could be much worse: as Bloomberg’s Paul Jarvis recalls, thirty years ago on this day traders around the globe were staring at their screens in disbelief as stock markets turned to a sea of red: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -10%, -9% and -10% respectively.

Fast forward to 2017 and the day known as Black Monday appears as little more than a blip in U.S. and European stock markets’ relentless progress. Having closed above the 23,000 mark for the first time on Wednesday, the Dow Jones Industrial Average has led markets back from the abyss, rising more than 13-fold since falling 23% in a single trading session on Oct. 19, 1987.

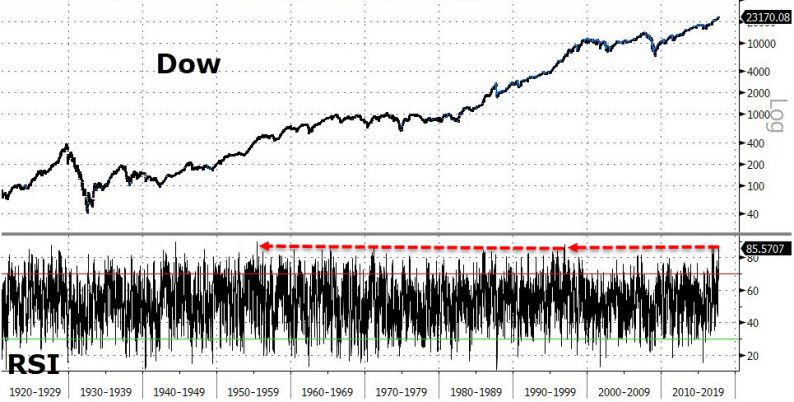

Then again, “all” it took was central banks collectively buying a little over 30% of global GDP in debt over the past 3 decades, and especially in the past 8 years, to create the world’s most artificial “bull market” and “recovery” in history, and one day there will be hell to pay, but not just yet. Instead, on “Not Green Thursday”, traders wake up today to a modern-day version of mini Black Monday, in which a sudden “risk-off” equity selloff has swept across global markets during early European trading, before gradually running out of steam, following a day in which the Dow Jones closed at one of its most overbought levels in the past 100 years.

US equity futures lead the move, with the VIX surging more than 1 vol to 11.550 (up 14%) the highest in five weeks, with Nasdaq futures heavily underperforming on reports of orders being cut for Apple iPhone 8. Losses compounded by poor earnings from major European names including SAP (-2.2%), Unilever (-4.8%) and Nestle (-0.6%); additionally, Hang Seng sold off into the close to end the day down 1.9%. As stocks sell off, USTs rally sharply in response, with the short end of the curve flattening again as the USD/JPY spikes lower, as do crude futures.

Here are the key overnight events that are having the biggest impact on this morning’s trading:

As Nanex’ Eric Hunsader shows, today’s trading session is shaping up – at least for now – as the biggest post-midnight selloff in the S&P in 2017.

Meanwhile, as noted earlier, Spanish bonds marginally underperform due to auction concession and confirmation that govt will suspend Catalan autonomy. NZD weakest in G-10 after new coalition govt is formed, with the potential for RBNZ mandate to, therefore, be expanded beyond inflation. Gold and VIX rally gave the risk-off sentiment

The Stoxx Europe 600 Index headed for the biggest drop in almost two months, with all industry sectors in the red, after Spain said it would move ahead with suspending Catalonia’s autonomy. Spanish shares lagged the benchmark and bond yields for peripheral Europe fluctuated.Underwhelming earnings from companies including Unilever and SAP SE further frayed investors’ nerves, already on edge amid concerns about the escalating Catalan stand-off, the lack of progress in Brexit negotiations and the search for a new Federal Reserve chief.

“European markets have started the day firmly on the back foot as a raft of company report earnings missed expectations, while investors await the next steps with respect to the constitutional crisis in Spain and today’s EU summit in Brussels,” said Michael Hewson, chief market analyst at CMC Markets U.K. “We look set for a lower U.S. open today. All eyes are likely to be on today’s meeting with current Fed chief Janet Yellen and U.S. President Trump with some Republicans calling for her to be allowed to leave.”

Meanwhile, in safe havens, bunds gained as European stocks slumped from the open. Spanish bonds softened as Spain moves ahead with suspending Catalonia’s autonomy, though bounced after solid auctions.

The late day sell-off in stocks in Hong Kong stood out in a mixed Asian session, as the Hang Seng crashed as much as 600 points, or 2.4%, in the last minutes of trading, coming even as China reported its economy expanded 6.8 percent last quarter, as traders focused on comments about household debt and asset bubble risk by PBOC governor Zhou.

The dollar rebounded from losses earlier in the week while the pound weakened as data showed U.K. retail sales dropped more than forecast in September, making third-quarter growth in the sector the weakest in four years. The euro briefly dropped before recovering. Haven currencies led G-10 gains amid risk-off mood as weak earnings dragged stocks lower.Elsewhere, the kiwi dollar plummeted 1.3% after New Zealand’s Labour Party got the backing of the nationalist New Zealand First Party to form a government, as reported earlier. China’s currency retreated even after data from the central bank suggested that the country is now seeing capital inflows. Iron ore fell the most since September.

Treasuries pared weekly losses and the greenback snapped a three-day winning streak. The euro felt the heat from latest Catalonia headlines, yet was supported by demand for upside ECB exposure, while sterling dropped the most in two weeks as soft U.K. data coincided with the start of EU summit.

In commodities, West Texas Intermediate crude fell 1.3 percent to $51.34 a barrel, the lowest in a week. Gold increased 0.3 percent to $1,284.68 an ounce. Copper declined 0.8 percent to $3.15 a pound.

In rates, the yield on 10-year Treasuries decreased two basis points to 2.32 percent. Germany’s 10-year yield dipped less than one basis point to 0.39 percent. Britain’s 10-year yield decreased three basis points to 1.288 percent. Japan’s 10-year yield declined one basis point to 0.067 percent.

Leave A Comment