Global stocks, S&P futures, the Mexican peso, the Korean Won and crude oil all fell as traders were spooked by polls suggesting a tightening race and Trump momentum ahead of next week’s American presidential election. The yen and Swiss franc gained, as did global bond markets and gold as investors flocked to safe haven assets.

The MSCI All Country World Index sank to its lowest since July Bloomberg observes, as shares slumped in Europe and Asia with futures foreshadowing a seventh day of losses for U.S. equities. The yen rose for a second day, while the Swiss franc and gold were near their highest levels in almost a month. Political upheaval weighed on South Korea’s currency, and New Zealand’s dollar strengthened after jobs data. Treasuries rose ahead of a Federal Reserve policy decision and crude oil fell after a report showed American stockpiles expanded.

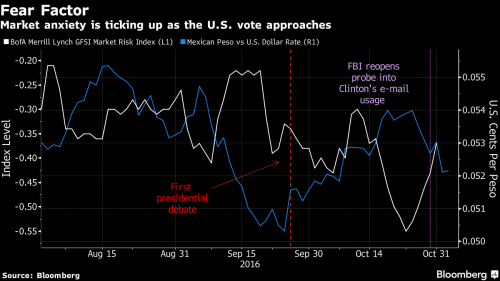

The risk off catalyst was yesterday’s ABC/WaPo tracking poll which showed Republican Donald Trump with 46 percent support to Democrat Hillary Clinton’s 45 percent, putting him ahead for the first time since May. A Bank of America Corp. index tracking volatility expectations in equities, bonds, currencies and commodities rose for five days through Monday, the longest run of increases since before the British vote to quit the European Union.

The flight to safety has led to a bid for both European bonds…

… and the traditional safe haven, the Swiss franc.

“Having had their fingers horribly burnt with the Brexit vote in June, financial markets appear to be starting to pare some risk in the lead up to next week’s U.S. Presidential vote, in the event that in circumstances that would probably have been unthinkable a week or so ago, that Donald Trump could win the U.S. Presidency,” Michael Hewson, chief market analyst at CMC Markets, writes in note.

Adding to today’s risk is the conclusion of the November FOMC meeting, which however is expected to reveal nothing new when the Fed presents its latest statement at 2pm. While the Fed is expected to leave interest rates unchanged when a two-day meeting concludes Wednesday, futures indicate a 68% chance of a rate hike by year-end and investors will be on the lookout for any hints the authority may give regarding the policy outlook. Bloomberg’s dollar index fell for a fourth day as some analysts said a Trump victory could spur volatility in financial markets and reduce the odds of a rate increase next month.

“The markets’ anxiety levels have moved up a gear,” adds Chris Weston, Melbourne-based chief market strategist at IG Ltd. This “suggests the bears have the upper hand, with the buying drying up and funds keeping their cash deployed for more certain times,” he said.

At 2pm all eyes will turn to the Fed where the FOMC outcome is due. Clearly this has been completely overshadowed by the election campaign and expectations of a policy move are unsurprisingly very low. The bigger question is how much of a green light signal do we get for December? The market is still pricing in a 70%ish probability for a December hike and so as DB’s Peter Hooper notes, the signal perhaps needn’t be stronger tonight than it has been already.

Looking at stocks, the Stoxx Europe 600 Index slid 0.7 percent as of 8:11 a.m. London time, falling for an eighth day ahead of the release of manufacturing data for the euro area. A.P. Moller-Maersk A/S tumbled by the most since June after the owner of the world’s largest container line reported a 43 percent drop in third-quarter profit.

The MSCI Asia Pacific Index fell by the most since September, with Japanese shares retreating from a six-month high before the nation’s financial markets shut Thursday for a holiday. Sony Corp. sank to a two-month low after the Japanese electronics maker’s quarterly profit missed estimates and Sumitomo Electric Industries Ltd. tumbled 12 percent after the company lowered its full-year earnings target. “The Trump risk is in revival,” said Chihiro Ohta, a Tokyo-based senior strategist at SMBC Nikko Securities Inc. “With Trump, there always follows an uneasiness over whether policies will be managed properly in the U.S., and given the holiday tomorrow in Japan, there’s no need to build positions at an uncertain time like this.”

Futures on the S&P 500 Index fell 0.2 percent ahead of the Fed decision and results from companies including Alibaba Group Holding Ltd. (BABA) and Facebook Inc. (FB)

Safe-haven demand boosted sovereign bonds, with 10-year yields falling across most of the developed world. The yield on 10Y Treasuries fell two basis points to 1.81 percent, after touching a five-month high of 1.88 percent in the last session. It’s unlikely the rate will climb too far past 2 percent anytime soon given how the American economy is performing, according to Jim Caron at Morgan Stanley Investment Management, which oversees $406 billion.

“Nobody really believes that rates can just rise very very quickly, or that bond prices can fall off a cliff,” Caron, who is based in New York, said Tuesday on Bloomberg Television. “You’re not seeing the growth. You’re not really seeing the inflation.”

Leave A Comment