Gold prices ended slightly lower Wednesday, ending a three-day streak of gains, as the dollar strengthened on the back of the better-than-expected U.S. data. The ADP Research Institute said businesses added 246K employees in January after a downwardly revised 151K gain in the prior month and the Institute for Supply Management reported that the index of national manufacturing activity climbed to 56 from 54.7 a month earlier. Investors tend to use ADP’s data to get a feeling for the Labor Department’s report, though these figures aren’t always accurate in predicting the outcome.

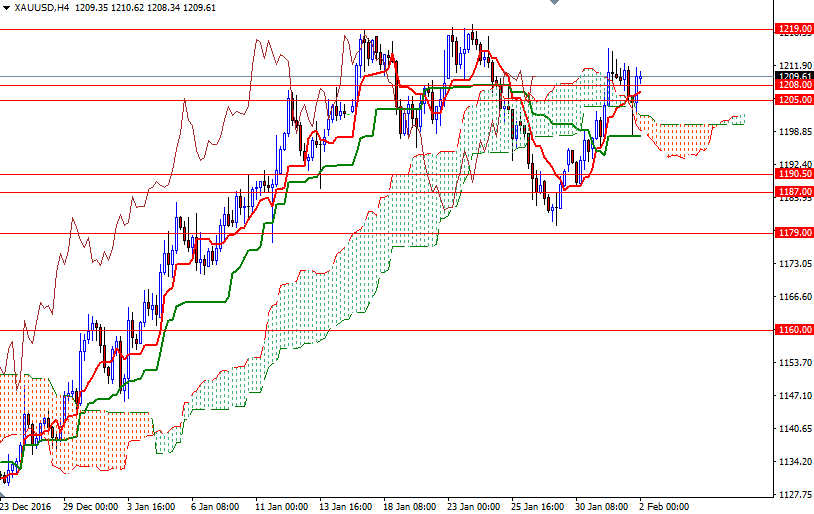

The Federal Reserve left interest rates unchanged – June is seen as the most likely month for the first rate hike of the year. The XAU/USD pair is trading above the Ichimoku clouds on the 4-hour chart. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the daily and 4-hourly charts, along with Chikou Span/Price crosses in the same direction. All these suggest that the bulls still have the near-term technical advantage.

If XAU/USD manages to climb and hold above 1213/2, we might see a bullish attempt targeting the 1220/19 region. The bulls will have to capture this strategic camp in order to gain momentum and challenge the bears on the 1225 battlefield. To the downside, keep an eye on the area occupied by the 4-hourly Ichimoku cloud. The bottom of the cloud and the Tenkan-sen coincide at around 1198 so therefore the bears will have to drag the market below that level so that they can put some pressure on the market. In that case, In that case, the market will be aiming for 1195 and possibly 1190.50-1187. As pointed out earlier this week, breaching this support is essential for a bearish continuation towards 1179/7.

Leave A Comment