Gold rallied nearly 2.5% on Wednesday as the dollar plunged after the U.S. Federal Reserve opted to leave interest rates unchanged and cut its expectations for rate rises this year. The Federal Open Market Committee said “A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation picked up in recent months… However, global economic and financial developments continue to pose risks” at the conclusion of a two-day meeting yesterday. Now officials see rates around 1% by end of 2016 vs. 1.5% previously expected.

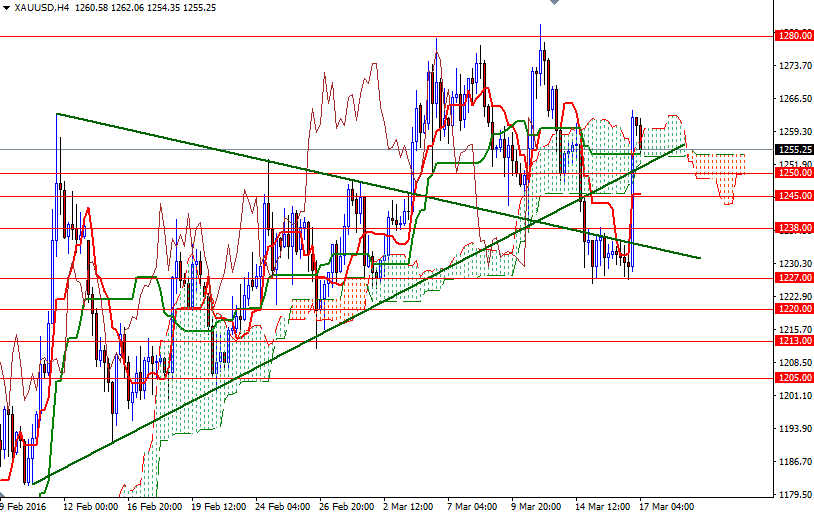

The XAU/USD is currently trading at $1255.25 an ounce, lower than the opening price of $1262.31. It looks like the market is digesting yesterday’s gains. Speaking strictly based on the charts, trading above the Ichimoku clouds (on both the weekly and daily charts) gives the bulls an advantage over the medium-term. We also have bullish Tenkan-Sen (nine-period moving average, red line) – Kijun-Sen (twenty six-period moving average, green line) crosses on both time frames.

To the downside, keep an eye on the 1254/0 region where a bunch of support levels such as the bottom of the cloud, Kijun-Sen and bullish trend line converge on the 4-hour chart. In other words, breaching this support is essential if the bears intend to make a fresh assault on 1245. A break down below 1245 could see a fall to 1238. The bulls will have to overcome the resistance at 1267.50 in order to set sail for the 1280 level. If the bulls continue to dominate the market and confidently push prices above 1280, look for further upside with 1285 and 1295 as targets.

Leave A Comment