Fundamental Forecast for Gold: Bullish

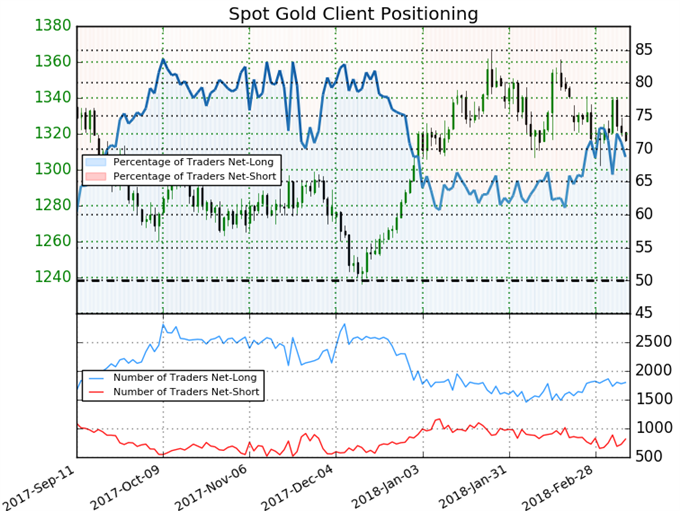

Gold prices are poised to close the week fractionally high with the precious metal trading at 1323 ahead of the New York close on Friday. It’s been a volatile week for bullion but the precious metal continues to hold a well-defined range after turning sharply from key support last week and prices are struggling to hold on to the early March gains.

A strong jobs report on Friday offered some support to gold prices with U.S. Non-Farm Payrolls (NFP) topping expectations with a print of 313K for the month of February. A strong read on labor force participation also highlighted underlying strength in the employment sector with a print of 63% (highest since September). Despite the job gains however, wage growth remained sluggish a downward revision to last month’s average hourly earnings accompanied by a miss in February at just 2.6% y/y (previously 2.8% y/y). The release is unlikely to alter the Federal Reserve’s expectations for three rate-hikes this year with gold finding solace into the close of the week.

Last week we noted that, “the technical levels remain clear with this week’s low marking a precise 100% extension off the highs– so is a low in place?” Gold prices have preserved this low with near-term price action pointing to a more constructive outlook next week. All eyes will be on the U.S. Consumer Price Index (CPI) report on Tuesday for an updated assessment on inflation outlook.

Leave A Comment