BoJ Leaves Policy Unchanged, but What Comes Next?

The Bank of Japan has employed QE programs since March of 2001 (in February of 2001, it still claimed that “QE will be ineffective” – it was right then, for the last time). These have had no effect apart from making a Keynesian government spending orgy possible that is unique in terms of its size in the post WW2 developed world. It is also unique insofar as it hasn’t yet blown up.

QE was briefly interrupted in 2006, when the BoJ reduced the monetary base by 25% within a few weeks (this barely affected the money supply, although we have to add the caveat that Japanese money supply data are not directly comparable to Western ones).

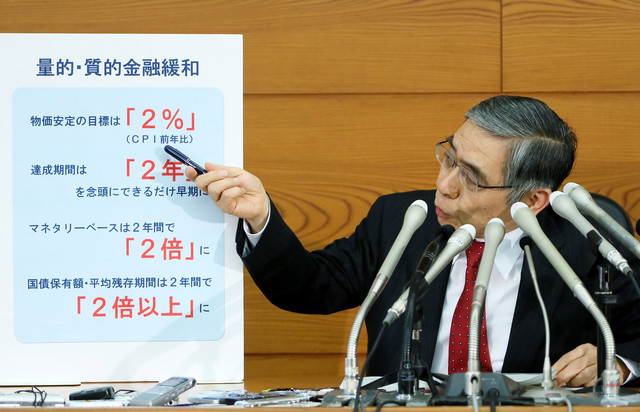

Kuroda demonstrating the loony-tunes 2% fetish of modern central bankers to journalists

Photo credit: Haruyoshi Yamaguchi / Bloomberg

After the GFC, governor Masaaki Shirakawa (?? ??) reluctantly restarted QE; he was essentially convinced that monetary policy flim-flam of this sort would be useless, but a lot of pressure was exerted and he ultimately gave in. Following Shinzo Abe’s election, it was clear that a more pliant BoJ leadership would be appointed, and not surprisingly, under governor Haruhiko Kuroda (?? ??), the BoJ has essentially decided to “go all in”.

The earlier QE programs that began in 2001 were considered “radical” at the time. We’re not sure what kind of adjective would be most fitting to describe the current exercise. “Completely lunatic” will probably do.

Yesterday, the BoJ decided not to add to its existing monetary pumping program, but voted once again to maintain the parabolic pace in asset purchases already underway. The entire exercise is based on the widely accepted, unproven, and utterly absurd neo-Keynesian shibboleth that the purchasing power of money mustdecline by 2% per year, as anything less is not considered “price stability”.

As we have pointed out before, the notion that the central planners should ensure “stable prices” goes back to Irving Fisher – back then, it produced the roaring 20s and the subsequent depression. The idea that “stable prices” should involve a steady low level (boiling frog type) destruction of purchasing power is of more recent vintage, but hardly an improvement on the original nonsense. As Reuters reports:

The Bank of Japan held off on expanding its massive stimulus program on Friday, despite pushing back the timing for hitting its inflation target by six months, blaming the delay mostly on energy price falls rather than any weakness in the economy. While BOJ Governor Haruhiko Kuroda maintained his optimistic outlook, two board members dissented to the bank’s baseline scenario that inflation will reach 2 percent by 2017 – exposing a rift between pessimists and optimists in the nine-member policy board.

At Friday’s rate review, the BOJ maintained its pledge to increase base money, or cash and deposits at the central bank, at an annual pace of 80 trillion yen (432.1 billion pounds) through aggressive asset purchases.

“This is what I would call decisive inaction on the part of the BOJ. They played this very much by the book, not leaving any room for confusion by waiting until after the market opened for its afternoon session,” said Stefan Worrall, cash equities manager at Credit Suisse in Tokyo.

Markets took the decision in stride with the Nikkei stock average rising to its highest in more than two months on news the government will compile an extra budget of over 3 trillion yen.

The central bank, however, will remain under pressure to expand its already massive asset-buying programme as slumping energy costs, weak exports, and a fragile recovery in household spending keep inflation well short of its 2 percent target, analysts say.

In a twice-yearly outlook report issued on Friday, the BOJ cut its forecasts and projected 0.1 percent inflation for the current fiscal year that began in April, followed by 1.4 percent inflation next year. It also pushed back the expected timing of achieving 2 percent inflation by six months, now projecting that price growth will hit the target in the latter half of the next fiscal year ending March 2017.

Kuroda said there was no discussion on easing policy at Friday’s meeting and stressed that Japan’s economy will recover moderately as global demand picks up, staying on track to reach 2 percent inflation.

Leave A Comment