Good Monday morning and welcome back. We made it through the ECB meeting, the UK election, and Comey’s eye-opening testimony last week and well, the major indices are none the worse for wear. Next up is this week’s Fed announcement (where Yellen’s gang is expected to raise rates another 25 basis points). In addition, there is the question if Friday’s tech wreck will continue. From my seat, it appears that Goldman’s “negative Nancy” view on tech sparked some much-needed profit taking in the big tech names. And while the selling could easily continue for a couple more days, let’s keep in mind that end of quarter “window dressing” (which is technically illegal) tends to be a powerful thing. So, we would not at all be surprised to see some dip buying come in during what appears to be (well, so far at least) a garden variety pullback in the market’s technology darlings.

Since it’s the start of a new week, let’s get right to our objective review the key market models and indicators. To review, the primary goal of this weekly exercise is to remove any subjective notions and ensure that we stay in line with what “is” happening in the markets. So, let’s get started…

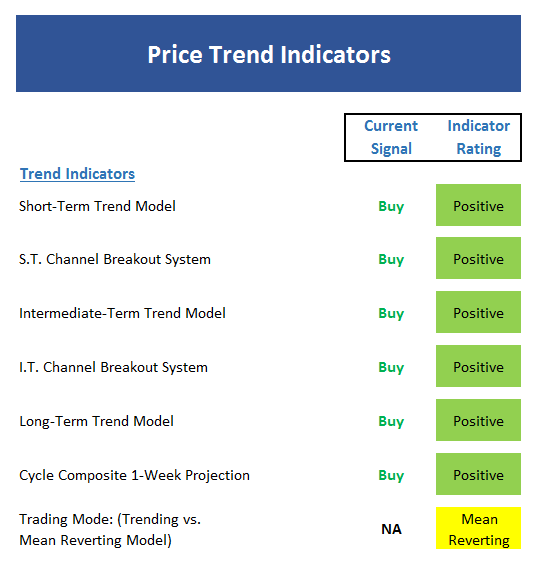

The State of the Trend

We start each week with a look at the “state of the trend.” These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

Leave A Comment