Inflation! Deflation!

Two words that strike fear into the hearts of investors.

Are such fears justified? Let’s take a look…

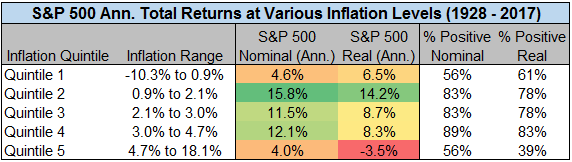

If we segment calendar year changes in the Consumer Price Index (CPI) into quintiles, we observe the following:

The lowest equity returns have occurred in deflationary (quintile 1) and inflationary (quintile 5) environments.

The highest equity returns have occurred in periods of low (quintile 2 & 3) to moderate (quintile 4) inflation.

Source Data for all tables herein: YCharts, BLS, Stern.NYU.edu/~adamodar

During years with the highest inflation (quintile 5):

Stocks generated the lowest nominal returns, 4% on average, with 56% of years posting a positive return. The real equity returns, at -3.5%, were also the lowest.

Many of the years represented in this quintile occurred during the 1970s (1970, 1973, 1974, 1975, 1976, 1977, 1978, and 1979) early 1980s (1980, 1981). Stagflation was the great concern of this period.

Many of the worst stock market returns in this quintile occurred during years in which the economy was in recession (1969, 1973-74, 1981, 1990).

During years with the lowest inflation (quintile 1):

Stocks generated an annualized return of 4.6% with 56% of years posting a positive return. The real equity returns, at 6.5%, were higher than the nominal returns due to the negative annualized CPI in this quintile.

Many of the years represented were during the Great Depression (1929-1932) and the subsequent decade (1938, 1939, 1940). Deflation was the great concern during this period.

Many of the worst stock market returns in this quintile occurred during years in which the economy was in recession (1929-1932, 1953, and 2008).

What’s left? The so-called “goldilocks” periods in which inflation was running neither too cold nor too hot (in a range between 1.2% and 4.7%). It was during these quintiles that stocks posted their best returns on both a nominal and real basis.

Leave A Comment