Welcome to edition 274 of Insider Weekends. Insider buying increased significantly last week with insiders buying $281.51 million of stock compared to $48.28 million in the week prior. Selling also increased with insiders selling $501.83 million of stock last week compared to $273.36 million in the week prior. A large part of the increase in buying was driven by the biotech investors Baker Brothers increasing their stake in Seattle Genetics (SGEN).

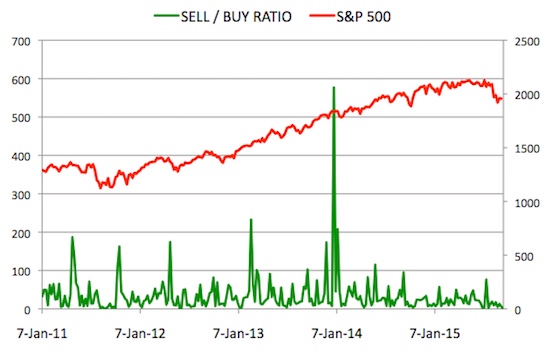

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week dropped to 1.78. In other words, insiders sold almost 2 times as much stock as they purchased. The Sell/Buy ratio this week compares favorably with the prior week, when the ratio stood at 5.7. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Insider Sell Buy Ratio September 18, 2015

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Barnes & Noble, Inc. (BKS): $13.26

Shares of this bookseller were acquired by 2 insiders:

This August, Barnes & Noble spun out Barnes & Noble Education (BNED) as a separate public company that operates college bookstores on 736 campuses nationwide. The company saw same store sales increase 1.8% in its fiscal first quarter ended August 1, 2015 and opened 21 new stores during the quarter but continues to remain unprofitable.

One of the reasons for a spin-off is to unlock value from an asset within the parent company. Unfortunately this has not been the case here with Barnes & Noble stock down more than 23% since the spin-off and Barnes & Noble Education down more than 2% since the spin-off.

Leave A Comment