Despite the approval of various Asian nation officials (e.g. Japan’s Amari: “Fed decision appropriate”), it appears non-hawkishness is not enough to keep the dream alive. Japan’s Nikkei 225 is down over 600 points from its post-FOMC spike highs, and USDJPY has tumbled over 1 handle – back below 120.00. Chinese stocks are extending losses after last night’s late tumble, as ironically, China’s securities regulator has uncovered a number of market manipulators who boosted prices of some stocks to sky-high levels during the peak of the bull market, attracting numerous followers who have suffered heavy losses in the recent market crash. The PBOC strengthened the Yuan fix for the 2nd day in a row (by the most in 2 weeks).

A sigh of relief from Japan’s leadership:

But it is not enough, as USDJPY and Nikkei 225 are tumbling…

And this did not help…

Which legged USDJPY lower still.

* * *

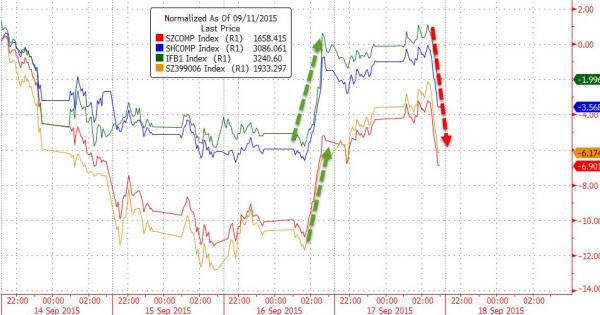

Broad asian equity markets weaker…

And China is opening lower, extending last night’s closing weakness…

Despite a 2nd day of releveraging…

Which is ironic since China’s securities regulator has uncovered a number of market manipulators who boosted prices of some stocks to sky-high levels during the peak of the bull market, attracting numerous followers who have suffered heavy losses in the recent market crash, according to Shanghai’s China Business News.

The China Securities Regulatory Commission (CSRC) has penalized two such manipulators, announcing on Sept. 11 the confiscation of 47 million yuan (US$7.3 million) of the illegal gains Ma Xinqi and Sun Guodong made from stock manipulation.

In its announcement, the comission described how Ma Xinqi jacked up the stock price of Beijing Baofeng Technology, an internet video company, by placing massive orders which were canceled shortly afterwards before selling off his original holdings of the stock, making huge gains.

Sun Guodong repeatedly bolstered the stock prices of Guangdong Qtone Education and 12 other listed companies by placing orders for those stocks before selling off his original holdings the following day.

Insiders pointed out that Ma and Sun are members of 10-dd “stock squads” focusing on investments in high-flyers, China Business News said.

“These stock squads, each boasting several hundreds of millions of yuan in funds, carefully study technical market charts and profit from investments of extremely short duration,” remarked an executive of a private equity fund, adding that in addition to their own money the squads also solicit funds to boost their clout in manipulating stock prices.

The private equity fund executive said both Ma and Sun are but minor players among the stock squads, however, pointing to their limited profits, according to the announcement of CSRC.

Market insiders suspect that Ma and Sun are followers of much greater forces manipulating stock prices, perhaps involving fund managers, which were behind the stock price rise at daily ceiling of Baofeng Technology for 34 trading sessions consecutively in March this year, according to China Business News.

“Institutional investors have driven the prices of many stocks with shaky fundamentals to sky-high level,” the private equity fund executive said.

Leave A Comment