Global equities continue to mock the bears. The MSCI World was up 2.6% on the month in January, comfortably outperforming yours truly, which had to contend with 1%. The MSCI World is now up a cool a 8.1% since November, and while we saw faint signs last of weakness last week, it was really only a minor flesh wound for the bulls. Indeed, Friday’s NFP number was a real treat for everyone. A solid headline and a poor wage print equal goldilocks and joy for both bond holders and equity bulls. As so often before, Spoos and Blues carried the day.

Last week I said that my valuation scores and stock-to-bond ratios are forcing me into a defensive position on equities. They also suggest that I should be buying bonds, or holding cash, rather than adding exposure to equities. That view hasn’t changed. On the other hand, I am seeing nothing in my short-term indicators to signal that the market is about to take a dump. Equites have had a good run and volatility is low, but that in itself is not a reason to get bearish. Indeed, I was fascinated by a note from JP Morgan this weekend arguing that that net supply of global equities turned negative last year, and that they expect it to remain close to zero this year. This is happening in a situation where retail investors have turned sceptical about the veracity of the bull market. Clearly, this structural story is not a recipe for a massive accident, but rather for a persistent grind higher.

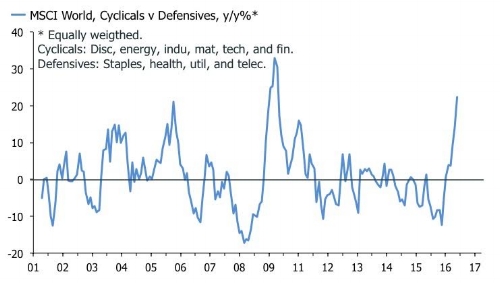

Instead, I think the key theme for asset allocators—as I argued a month ago—is to look within sectors. And here, the story is getting increasingly interesting. Whatever the medium-to-long run merit of the reflation trade is, my first chart shows that investors would be wise to curb their enthusiasm slightly.

If we break down this story, a number of juicy pair-trades are now on offer for long-short investors. The first chart shows the trailing y/y returns of consumer discretionaries and staples relative to materials, and the second shows relative returns for healthcare versus an equally weighted average of energy and materials. The message is clear; forget about trying to capture the twists and turns of the Spoos or the Dow; it’s all about sector rotation.

Leave A Comment