Should the Fed raise the base interest rate? They really shouldn’t at this point. Will they? They probably will because they still see years of growth. I do not see years of growth ahead… Let me explain.

Almost one year ago I wrote that capacity utilization would start falling. (link) It has fallen since that time, even until today’s report that capacity utilization in August was 77.6%. This number was below expectations but perfectly in line with a limit line in a model that I use.

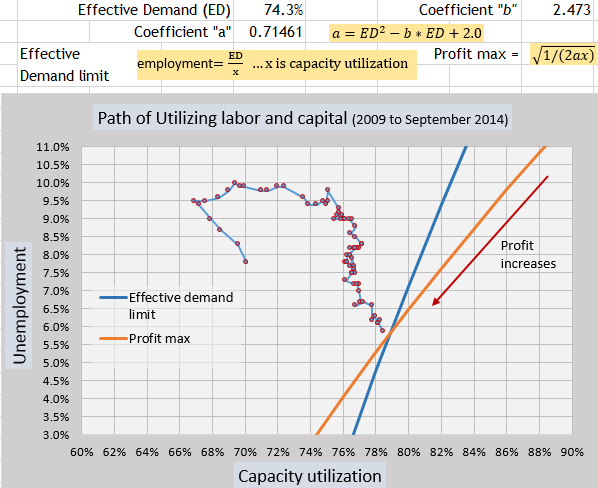

The model plots the movement of capacity utilization and unemployment. The model has two limit lines that act upon the increasing utilization of labor and capital. One for Effective Demand (basically labor share) and one for Profit Maximization (equation in graphs). The utilization of labor and capital moves toward the limits during a business cycle to increase profits. Once the movement hits the limits, profits are further increased by only moving downward along the limits, which means that capacity utilization will decrease as unemployment falls. This pattern has existed for decades before a recession. When the plot starts to pull away from the limits, a recession is beginning.

Here is the model from a year ago.

When I saw the plot reaching the limit lines last year, I wrote…

“My sense is that firms are in a race to maintain profit shares at the end of a business cycle. They felt the chill of declining profits in September. From here on out, firms will have to contract in order to maintain profit shares, as seen by the plot hitting the orange line. Now firms will have to contract capital utilization while trying to maintain the same output in order to maintain profit rates.”

So here is the model with data since September of 2014. The coefficients seen at the top are the same in both graphs for easier comparison. The coefficients though can change if labor share was to significantly change.

Leave A Comment