Though we’ve seen markets swing a bit recently, we’re still in positive territory for the year. This time on Financial Sense Newshour, we spoke with Dave Nicoski of Vermillion Research for his take on whether recent pullbacks hint at a more significant correction, or if this is just a pause for markets to catch up.

Nicoski discusses market breadth, favorable sectors, and concerns over interest rates. Here’s what he had to say in our recent podcast…

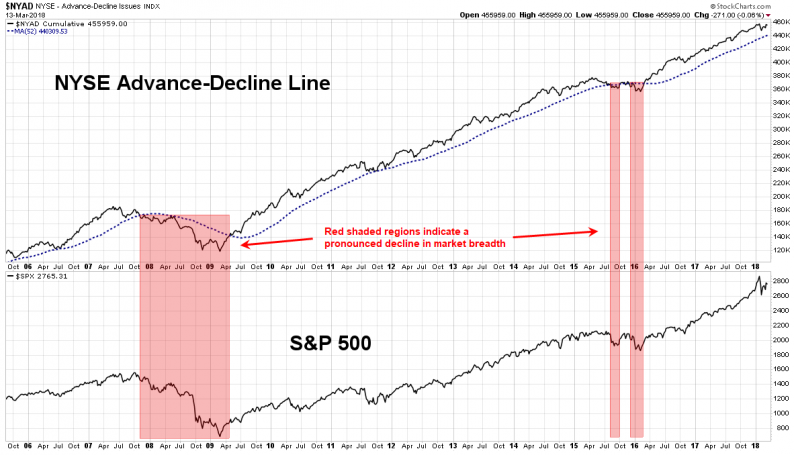

Breadth Not Indicating a Top, Consolidation More Likely

The breadth of the market is not deteriorating, Nicoski noted, which doesn’t indicate a market top at this point.

“There is some concern in the marketplace on whether or not this pullback that we had is just going to be a point in time where we had a longer-term consolidation,” he said. “(The latter) is what we’re seeing.”

The overall indices’ long-term uptrends remain intact across the board. However, there is some cause for concern in the short-run when we see parabolic moves as we saw prior to the February correction.

What Looks Good Now?

Biotechs are actually doing quite well, Nicoski noted. Within the Consumer sector, retailers look the best.

Financials continue to look great, and Nicoski recommended looking at the large-cap banks. On a relative basis, small-cap banks are starting to show some significant outperformance over the last 3 to 4 weeks versus the market.

As long as Financials aren’t going down, Nicoski stated, we have a great backdrop for the market as a whole.

“I don’t need them to lead,” he said. “I just don’t need them to hit the 52-week price and relative-strength lows, and then it would be much more of a concern that this pullback that we’ve recently seen is a top in the market. I don’t think we can wave that flag yet. We just need a pause. We can pull back the 200-day moving averages on stock through time, and that’s what I think is happening.”

Leave A Comment