…The short answer: Not much.

By now everyone has heard about the recent volatility to start off the new year. While we all wish it weren’t true, the reality is that stocks are called risk assets for a reason, that being that sometimes they go down.

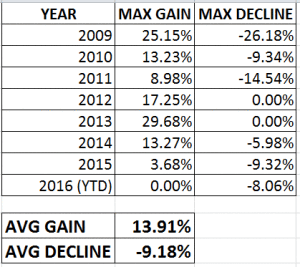

Above average declines can be scary because the markets tend to take the slow and steady route when they rally, and the elevator straight down when they decline. The good news is that this is nothing we haven’t seen before and will likely see again. The above picture shows the maximum declines and maximum gains in the S&P 500 since the 2009 bull market rally began. 5 out of the 7 years we’ve seen decent sized declines, with the average decline of 9.18%. Meanwhile the S&P 500 continued higher, gaining more than 200% during this time, from low to high.

As I type this the S&P 500 is showing a loss of 8.5% for 2016, which is about in line with the average during this current bull market. Sometimes markets trade on emotions rather than fundamentals. And 2016 appears to be no exception. In a prior post, I addressed the potential for those August 2015 lows to be revisited.

Let’s address the issue of China. US exports to China account for less than 1% of US annual GDP. China accounts for only about 7% of revenues for S&P 500 companies. China’s GDP growth output has declined substantially. However China’s economy has doubled in the last 10 years. So even if China’s GDP has contracted by 50%, there is a good chance that the same level of output remains. China does have some serious stability issues to address, and they will eventually figure it out.

Interest rates is more concerning. In a prior post we talked about the short term market reactions to the initial rate increase, and they usually weren’t great. However in almost all cases the markets were higher 12-24 months out. It does appear that the Fed is a bit disillusioned and perhaps the markets are concerned another 1937 scenario could be playing out.

Leave A Comment