As banks have trickled out their third quarter balance sheet filings, we gain more insight into the events of that quarter as well as some additional color as to the ongoing drama of the current one. Perhaps the most startling shift in an otherwise quite busy and at times despondent period was the universal compression of swap spreads into negative territory. As stated before, a negative swap spread holds no interpretative meaning, the very fact of which is the most important element. In other words, we don’t have to figure out what the “market” is saying about a negative spread because it isn’t saying anything other than “something” is wrong (and very wrong with so many and deeper negative and compressed maturities).

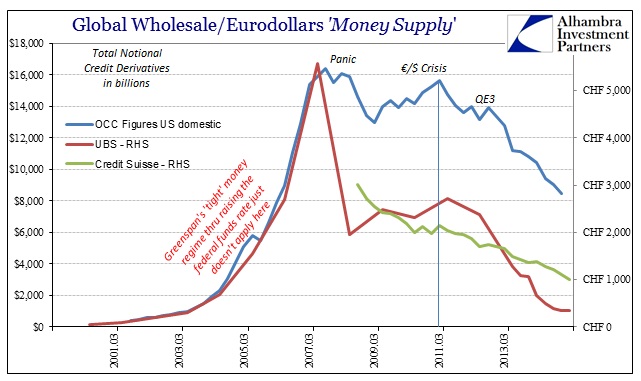

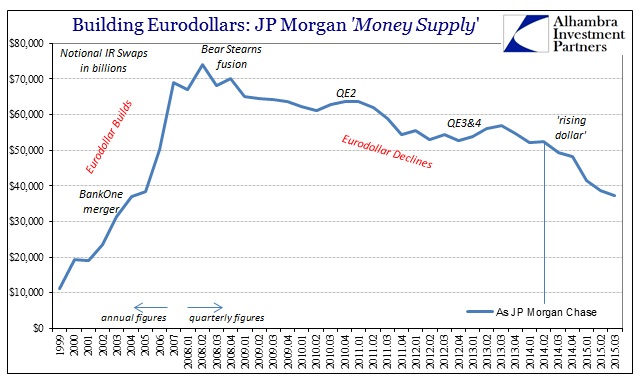

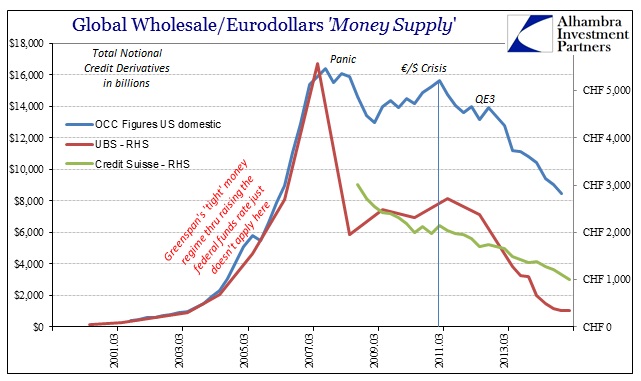

This has been, of course, an ongoing theme that predates the most lucid visuals of the current period; in fact, this is a traceable relic to the Panic of 2008 (which should be renamed the Eurodollar Panic of 2008, or perhaps the Great “dollar” Run). In the past year or so I have chronicled the obvious shift in what I call dark leverage capacity of eurodollar bank balance sheets, mostly in the form of interest rate swaps and credit default swaps (acknowledging that the latter are edging closer to extinction; or are they?). The decline in aggregated gross notional amounts of reported derivative contracts, a simple proxy of approximated balance sheet capacity “offered” by dealer banks, has been simply stunning.

Therefore, it seems logical that if swap spreads have turned so very drastic in recent months we might expect an even more remarkable withdrawal of dealer capacity reported with Q3. That hasn’t been the case, however, as gross notionals continue to decline but only slightly in Q3 compared to the dramatic departure in Q2.

As with balance sheet capacity issues and dealer tendencies during the 2008 panic, we have to remember that there are many sides to such “dollar” dark leverage-drawn liquidity. In very broad terms, dealers are supplying derivatives in order to turn math into money, but that straight away suggests someone on the other side as “demand.” In good part, that is the dealers themselves as they form a partially incestuous circle of issuing “risk” absorption to each other while simultaneously laying it off to each other. This is one reason there is no beginning nor end to the eurodollar space, as it just is.

Again, as you can see below, outside of UBS there weren’t sharper departures in reported gross notionals on either IR swaps or credit derivatives. In fact, the reported balances were in most cases only slight (we will see when the OCC and BIS reports for Q3 are issued if there are any deviations, but given that there are only a handful of impactful dealers in the world and I have captured a sizable portion in these anecdotes that would be surprising).

Liquidity itself is an often misunderstood concept, particularly since liquidity may operate in almost perfection 99.9% of the time; but when it fails on that 0.1% the extremes that result are, to be understated, noticeable. I think it fair to classify the events of August (and September, certainly in Asian “dollar” terms connected to China) as just such an extreme. Thus, if dealers were not obviously retreating in heavy fashion but liquidity produced such results, then the “fault” lies on the “other” side of the equation.

Leave A Comment