The tete-a-tete between Italian citizens and former Prime Minister Matteo Renzi came to a head last week. The country voted “No” to Renzi’s proposed restructuring of Italian banks and austerity measures. I assumed the “No” vote would send global markets into a tailspin, but markets actually rallied. The next order of business is a bail out of Banca Monte dei Paschi di Siena (BMDPY).

The Situation

Italy’s eight banks are in various stages of distress. They have EUR360 billion of problem loans versus EUR225 billion. Banca Monte dei Paschi di Siena (“BMPS”) is one of the most-indebted. In Q3 the bank had a EUR1.2 billion loss. Net interest income and fees and commissions on a combined basis fell 3% Y/Y. Pretax profit was EUR423 million, down about 20% Y/Y. The biggest driver of the loss was a EUR1.3 billion loss provision, up from EUR372 million in Q3 2015.

Non Performing Exposures Are A Problem

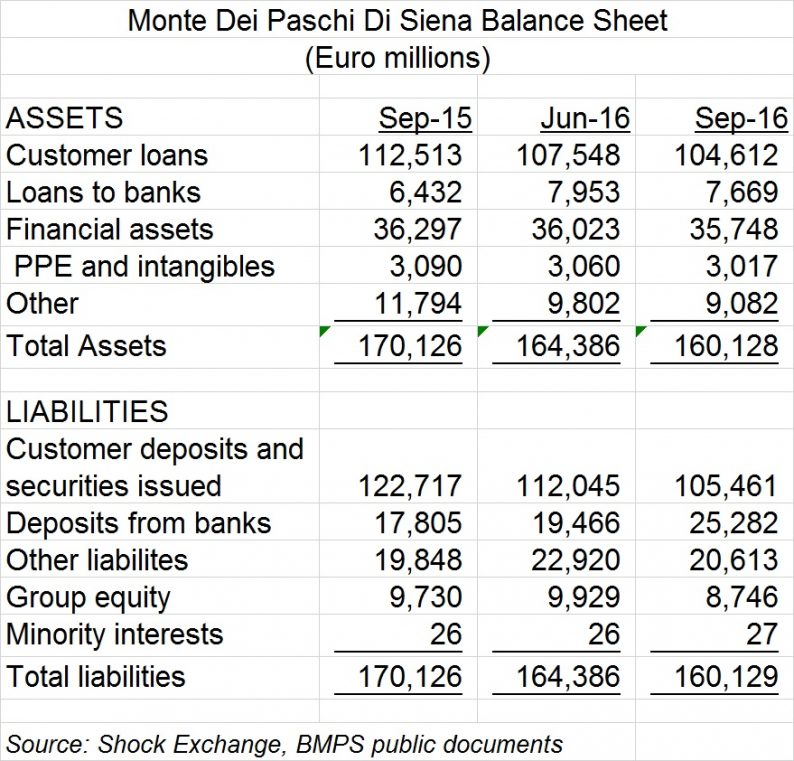

Below is a snapshot of the bank’s balance sheet.

Loans were EUR104.6 billion at September 2016, down 7% Y/Y due to a decrease in commercial lending. Direct funding (EUR105.5 billion) fell 14% Y/Y and was negatively impacted by large outflows at the beginning of Q3 2016. The rapid decline in bank funding could connote that depositors have become nervous about leaving their money at the bank.

Non Performing Exposures At EUR 22.5 Billion

The company’s non performing exposures (“NPE”) were EUR22.5 billion at September 2015. That equated to 21.5% of customer loans. Of that, EUR10.9 billion (48%) was considered bad loans, EUR10.1 billion (45%) was unlikely to pay and EUR1.5 billion (7%) were past due / overdue exposures.

NPE dwarfs the company’s EUR8.7 billion group equity. If only 48% of the NPE was not repaid it would completely wipe out the bank’s equity.

New Restructuring Plan For BMPS?

BMPS already had proposed a restructuring plan that would allow it to shed bad loans and raise EUR5 billion in funds from private investors, including Qatar Investment Authority. Through fresh capital and government guarantees the original plan was expected to increase coverage of bad loans and securitize them; it was also expected to help certain of the bank’s creditors to avoid a write-down of their exposures. However, the private-funding deal is now unlikely. The “No” vote could create political and economic uncertainty and scare away private capital.

Leave A Comment