“Davidson” submits:

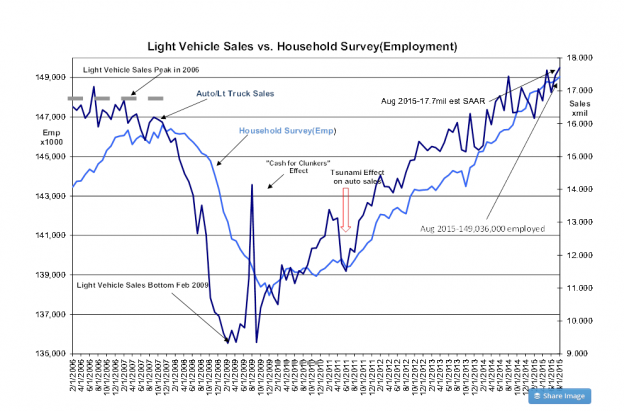

Last week Aug Vehicle Sales pace were reported at 17.7mil SAAR (Seasonally Adj. Annual Rate) and this morning the Household Survey (Emp) came in at 149,036,000 employed or 196,000 above the July 2015 count-see the chart below. Great uptrends in both Vehicle Sales and Employment! The MCAI rose in August by 0.6 to 126.1-see the chart below-indicating easing lending conditions for home buyers which is the right direction, but still well off the 250-300 level which in my opinion is required to satisfy the pent-up demand for single-family housing. All other important economic data support continuing economic expansion. Gallup Job Creation was just reported at a record high.

As usual much in the media found that these reports justified overly pessimistic commentary. It is from such dichotomies that produce significant shifts higher in equities. Higher/lower equity prices ALWAYS comes from being surprised by actual economic conditions. That markets have forever shifted after the fact can be seen through comparisons of past economic trends vs. equity prices. Today, we have access to literally 100s of thousands of data sets from the St Louis Fed-FRED. As of today, the site lists 288,000 series covering global economic data. Last week it was 267,000 and when I first discovered this site in 2005 they listed only a few thousand. All this data is free to investors.

The economic data clearly indicate we are well into economic expansion and have been so since early 2009. Perhaps the greatest deception is a result of our own proclivity (likely a genetic based survival trait) to pay far more attention to negative, fearful stories. Humans virtually ignore good news except when the majority of us are in near celebration of it. We do have a lemming quality to accepting consensus opinion as it has been established by ‘recognized experts’. Market prices are if anything representative of human psychology at any moment in time. Value Investors who are less connected emotionally than most of us see through this psychological haze. Value Investors tend to be seen by most as ‘cold hearted’ because they are numbers and returns oriented. Value Investors perceive value over periods which make Momentum Investors shudder, i.e. 3yrs-5yrs and longer vs. the minutes, hours and couple of days of trader’s typical holding times. Momentum Investors, likely more than 95% of all investors, believe that price trends tell one all one needs to know. Value Investors dig deeply into financials to understand business returns and economic data to comprehend business cycles. Momentum Investors view the Value Investor as a waste of time. Useless, really! There is such a major difference in perception between Value and Momentum Investors that having a discussion between them is like trying to mix oil with water. Today there are many reports of Value Investors buying new equity positions. These reports include Wilbur Ross, Warren Buffett, Leon Cooperman, Ken Langone and Dick Kovacevich. (Really too many to mention)

Leave A Comment