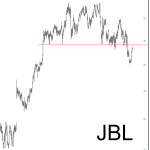

Natural gas on the Nymex had a very volatile week before closing 3% lower than the previous one at $1.92. EIA reported on Thursday a build of 92 Bcf in working underground stocks. Total inventory is currently at 2,425 bcf, 22.1% higher y/y, 37% above the 5-year average. Both percentages are beginning to appear at a descending at the start of this new injection season. PexelsWe have started our buying operations ahead of the winter Call options. We believe that the floor was at recent $1.50 – $1.70s. We like to buy any dip coming our way as we believe that the market will soon test the $2.30 resistance. The seasonal break-out will occur right after this range-bound shoulder season, on larger trading volumes of the summer contracts and the lower number of active rigs.The June contract is already offering us a higher support level from the recent seasonal floor. We need to be careful for another couple of weeks though, as the Daily MACD is looking ready to cross bearish. This move, if it happens, it will not last for long. We need to see higher highs before being sure about the next breakout in uptrend later in summer. I believe that too many market participants are gearing-up for buying operations so the direction will be the one we have been anticipating and we feel safe buying the dip on the near-term charts.Every time this commodity trades at a fair price, it shows the world how stable it can be and how it can make a difference in a healthy energy transition that leaves no citizen behind and supports the energy security. U.S. macro data and the Dollar against majors must be routinely monitored. Daily, 4hour, 15min MACD and RSI are pointing to entry areas.

PexelsWe have started our buying operations ahead of the winter Call options. We believe that the floor was at recent $1.50 – $1.70s. We like to buy any dip coming our way as we believe that the market will soon test the $2.30 resistance. The seasonal break-out will occur right after this range-bound shoulder season, on larger trading volumes of the summer contracts and the lower number of active rigs.The June contract is already offering us a higher support level from the recent seasonal floor. We need to be careful for another couple of weeks though, as the Daily MACD is looking ready to cross bearish. This move, if it happens, it will not last for long. We need to see higher highs before being sure about the next breakout in uptrend later in summer. I believe that too many market participants are gearing-up for buying operations so the direction will be the one we have been anticipating and we feel safe buying the dip on the near-term charts.Every time this commodity trades at a fair price, it shows the world how stable it can be and how it can make a difference in a healthy energy transition that leaves no citizen behind and supports the energy security. U.S. macro data and the Dollar against majors must be routinely monitored. Daily, 4hour, 15min MACD and RSI are pointing to entry areas. More By This Author:Natural Gas: Identifying The Seasonal Floor

More By This Author:Natural Gas: Identifying The Seasonal Floor

Natural Gas: Working Underground Stocks Too High

Natural Gas: Selling Rallies On Exhaustion

Leave A Comment