Natural gas prices declined another 2.5% today after gapping up modestly last evening. Prices lingered up into this morning before a wave of morning sellers hit prices hard, and we were unable to recover losses through the trading day, settling just a couple cents off the lows.

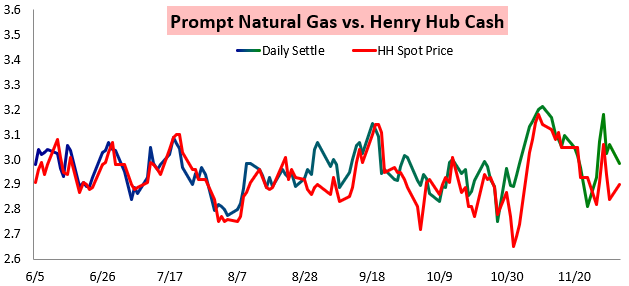

Cash prices were not quite as pressured, actually rising slightly after Friday’s intense selling.

The result was another decline in the prompt/cash spread, which was near the top of its range to close out last week.

Despite intense selling along the entire natural gas strip, F/G was relatively firm, indicating it is not near-term weather that appeared to be driving price action (as significant cold is still forecast to pull heating demand above average over the next 2 weeks).

Rather, it appears the market initially reacted to bullish weather expectations last evening, when it gapped up on weekend GWDD adds. This fit with our analysis in our Friday Pre-Close Update, where we warned clients that bullish weather risks over the weekend would likely allow prices to remain elevated headed into the next week.

Yet in that same report we similarly warned that the natural gas technical picture was deteriorating heading into the weekend.

Clearly, weather was unable to bail us out today, and the entire strip moved another leg lower. For those looking further along the natural gas strip, this was not much of a surprise, as selling on Friday hit not just the front of the natural gas strip but also contracts into 2019, as seen in our Morning Update today.

This would seem to indicate that the market focused more on long-term supply/demand balance than weather today, though we have noticed a varied role for weather in price act

Leave A Comment