The New Zealand dollar has been very resilient in the face of mostly weaker data. Dairy prices dropped by the largest amount in a year, the trade deficit widened while Q3 GDP growth slowed. Although investors were relieved that GDP did not contract as much as it could have given the recent weakness in trade and retail sales, the data still shows a moderating economy. As a result, we continue to look for challenging times ahead as the softness of dairy prices hits farmers. Risk appetite is the only thing keeping NZD/USD supported and we may not see much of that next week.

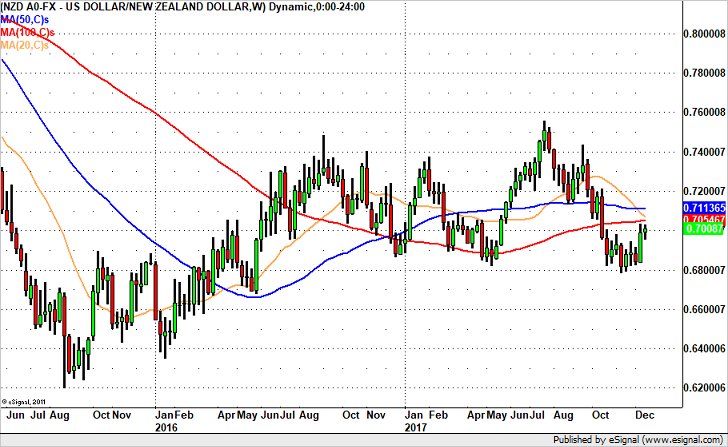

Technically, NZD/USD has been consolidating near the top of its recent range. With many moving averages hanging above on the daily and weekly chart, we expect gains to be capped at 0.7050 and look for a pullback to at least .6925.

Leave A Comment