Weekly Major Markets Forecast: Gold heads for $2500, Silver squeezes shorts. EUR/GBP eyes 0.86 breakout. DAX, S&P 500, and CAC show recovery signs; NASDAQ eyes 18,500. EUR/JPY bullish, targeting ¥165.Gold  Gold markets have had another explosive week to the upside, and it certainly looks as if any time this market pulls back there are plenty of buyers willing to get involved. In general, gold continues to move higher due to geopolitical concerns, and of course the fact that central banks around the world continue to buy gold. At this point, it has become a completely momentum driven market, and I would expect some type of pullback. I would also expect a massive amount of support near the $2200 level. Longer-term, I think this market goes looking to the $2500 region. Silver

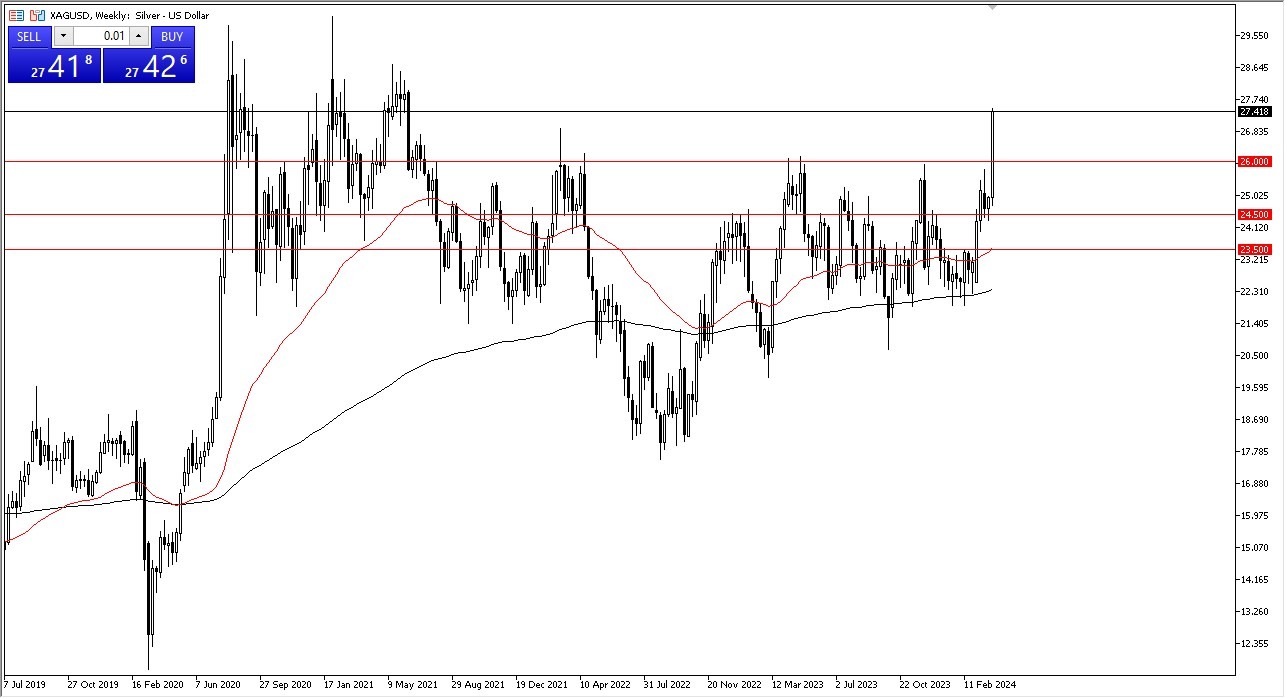

Gold markets have had another explosive week to the upside, and it certainly looks as if any time this market pulls back there are plenty of buyers willing to get involved. In general, gold continues to move higher due to geopolitical concerns, and of course the fact that central banks around the world continue to buy gold. At this point, it has become a completely momentum driven market, and I would expect some type of pullback. I would also expect a massive amount of support near the $2200 level. Longer-term, I think this market goes looking to the $2500 region. Silver  Silver also took off to the outside during the course of the trading week, slicing through the $26 level. This is interesting, considering that most commercial contracts in the commitment of traders report had shown that they were extraordinarily short. This has all the hallmarks of a “short squeeze”, as a lot of traders may have gotten caught on the wrong side of this. Much like the gold market, I do think that we probably have more upward pressure, but we desperately need some type of pullback in order to find the ability to build up plenty of momentum in this market and send it higher. At this point, I think the $26 level will offer a significant support level. EUR/GBP

Silver also took off to the outside during the course of the trading week, slicing through the $26 level. This is interesting, considering that most commercial contracts in the commitment of traders report had shown that they were extraordinarily short. This has all the hallmarks of a “short squeeze”, as a lot of traders may have gotten caught on the wrong side of this. Much like the gold market, I do think that we probably have more upward pressure, but we desperately need some type of pullback in order to find the ability to build up plenty of momentum in this market and send it higher. At this point, I think the $26 level will offer a significant support level. EUR/GBP  The euro initially fell during the course of the trading week, only to turn around and show strength against the British pound. At this point, the 0.86 level looks to be significant resistance, and if we can break above there is likely that the market would continue to go much higher. The 50-Week EMA just above offers a significant amount of technical resistance as well. In general, this is a market that looks very much like it is trying to form some type of base so that it can break out to the upside and go looking to the 0.8750 level over the longer term. At this point, it looks like the 0.85 level underneath will continue to be a hard “floor in the market.” DAX

The euro initially fell during the course of the trading week, only to turn around and show strength against the British pound. At this point, the 0.86 level looks to be significant resistance, and if we can break above there is likely that the market would continue to go much higher. The 50-Week EMA just above offers a significant amount of technical resistance as well. In general, this is a market that looks very much like it is trying to form some type of base so that it can break out to the upside and go looking to the 0.8750 level over the longer term. At this point, it looks like the 0.85 level underneath will continue to be a hard “floor in the market.” DAX  The German DAX fell significantly during the course of the week, but it’s worth noting that the Friday session ended up being a beautiful hammer, and it does suggest that we are more likely than not going to rally from here. If we do, I think it’s very likely that the market will continue to go back and forth in consolidation after what has been a very strong move to the upside. On the other hand, if we were to break above the highs of the week, then it allows the market to go looking toward the €19,000 level over the longer term. I have no interest whatsoever in trying to short this market. SP 500

The German DAX fell significantly during the course of the week, but it’s worth noting that the Friday session ended up being a beautiful hammer, and it does suggest that we are more likely than not going to rally from here. If we do, I think it’s very likely that the market will continue to go back and forth in consolidation after what has been a very strong move to the upside. On the other hand, if we were to break above the highs of the week, then it allows the market to go looking toward the €19,000 level over the longer term. I have no interest whatsoever in trying to short this market. SP 500  The S&P 500 plunged during the week as well but had an extraordinarily strong Friday. At this point, it looks like we are trying to close above the 5200 level, which is an area that a lot of people would be paying close attention to. It’s a large, round, psychologically significant figure, and an area where we had seen previous resistance multiple times on the weekly timeframe. The fact that the candlestick looks a little bit more like a hammer suggest that we are at the very least going to find our footing in this general vicinity. On the other hand, if we were to break down below the bottom of the candlestick, then it opens up the possibility of a move to the 5000 level underneath which of course is a large, round, psychologically significant figure. NASDAQ 100

The S&P 500 plunged during the week as well but had an extraordinarily strong Friday. At this point, it looks like we are trying to close above the 5200 level, which is an area that a lot of people would be paying close attention to. It’s a large, round, psychologically significant figure, and an area where we had seen previous resistance multiple times on the weekly timeframe. The fact that the candlestick looks a little bit more like a hammer suggest that we are at the very least going to find our footing in this general vicinity. On the other hand, if we were to break down below the bottom of the candlestick, then it opens up the possibility of a move to the 5000 level underneath which of course is a large, round, psychologically significant figure. NASDAQ 100  The NASDAQ 100 initially plunged during the week right along with the rest of stock markets, but it looks like the 17,750 level will continue to offer support. All things being equal, the market is likely to continue to see plenty of buyers for an opportunity to pick up “cheap contracts.” At this point in time, we can break above the highs of the week. I think that the NASDAQ 100 will continue to go higher, perhaps reaching the 18,500 level, and then perhaps even the 19,000 level. CAC

The NASDAQ 100 initially plunged during the week right along with the rest of stock markets, but it looks like the 17,750 level will continue to offer support. All things being equal, the market is likely to continue to see plenty of buyers for an opportunity to pick up “cheap contracts.” At this point in time, we can break above the highs of the week. I think that the NASDAQ 100 will continue to go higher, perhaps reaching the 18,500 level, and then perhaps even the 19,000 level. CAC  The Parisian CAC fell hard during the week, but the weekly chart doesn’t show that the Friday candlestick is in fact a hammer, and it suggests that buyers are coming back in to pick up this market. Ultimately, I think this is a market the trays to go back to the highs again and given enough time very well could. The 7900 level underneath should continue to offer support as well, so I still prefer “buying on the dips.” EUR/JPY

The Parisian CAC fell hard during the week, but the weekly chart doesn’t show that the Friday candlestick is in fact a hammer, and it suggests that buyers are coming back in to pick up this market. Ultimately, I think this is a market the trays to go back to the highs again and given enough time very well could. The 7900 level underneath should continue to offer support as well, so I still prefer “buying on the dips.” EUR/JPY  The euro rallied significantly during the course of the trading week against the Japanese yen, as we continue to see the Japanese yen continue to get pummeled by most currencies around the world. The interest rate differential continues to drive this pair higher, therefore it’s likely that it remains a “buy on the dips” type of situation, and therefore value hunting is the best way to go when it comes to this market, and I do believe that given enough time we could break above the ¥165 level.More By This Author:EUR/USD Forecast: Reaches Fair ValueGold Forecast: Continues To Find BuyersNasdaq 100 Forecast: Continues To See Volatility

The euro rallied significantly during the course of the trading week against the Japanese yen, as we continue to see the Japanese yen continue to get pummeled by most currencies around the world. The interest rate differential continues to drive this pair higher, therefore it’s likely that it remains a “buy on the dips” type of situation, and therefore value hunting is the best way to go when it comes to this market, and I do believe that given enough time we could break above the ¥165 level.More By This Author:EUR/USD Forecast: Reaches Fair ValueGold Forecast: Continues To Find BuyersNasdaq 100 Forecast: Continues To See Volatility

Leave A Comment