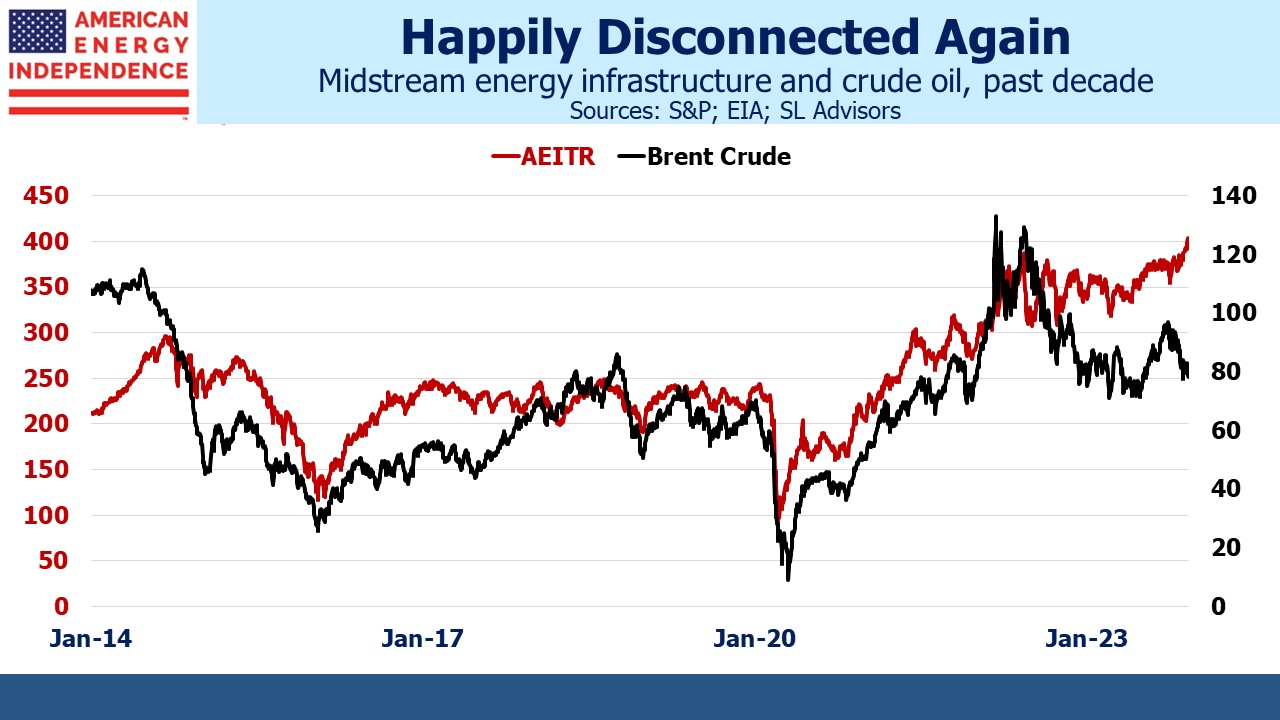

Brent crude currently trades for around $4 per barrel less than a year ago. Back then Goldman Sachs published another highly convincing research report predicting higher oil driven by increasing demand and chronic underinvestment in new supply. Since then Jeff Currie has left the firm, hopefully not because of his not yet vindicated commodity super cycle thesis. Plenty of other firms were bullish. JPMorgan was cautiously looking for prices to be $6 higher. Few were loudly negative.It’s therefore been an opportune moment for midstream energy infrastructure, as represented by the American Energy Independence Index (AEITR) to separate itself from oil and move higher. The chart shows the two started to move more synchronously in 2015. This was roughly when the global oil market woke up to the increased supply provided by the US shale revolution. Pipeline companies had increased their capex to support higher volumes. This increased their sensitivity to oil prices, exacerbated by increasing leverage.The “toll road” model of MLPs became deeply discredited. Distribution cuts followed. Corporations fared far better than MLPs. The current quarterly distribution of the Alerian MLP ETF (AMLP) remains 41% below its 2016 peak. This distribution is also now all classified as ordinary income, rather than as a return of capital which acts as a deferral of taxes (see AMLP Fails Its Investors Again).The pandemic brought another co-ordinated swoon in oil prices and pipeline stocks, although both soon recovered, leaving only the hapless investors in closed end MLP funds with any lasting damage since they’d had to deliver at the lows (see MLP Closed End Funds – Masters Of Value Destruction).

The chart shows the two started to move more synchronously in 2015. This was roughly when the global oil market woke up to the increased supply provided by the US shale revolution. Pipeline companies had increased their capex to support higher volumes. This increased their sensitivity to oil prices, exacerbated by increasing leverage.The “toll road” model of MLPs became deeply discredited. Distribution cuts followed. Corporations fared far better than MLPs. The current quarterly distribution of the Alerian MLP ETF (AMLP) remains 41% below its 2016 peak. This distribution is also now all classified as ordinary income, rather than as a return of capital which acts as a deferral of taxes (see AMLP Fails Its Investors Again).The pandemic brought another co-ordinated swoon in oil prices and pipeline stocks, although both soon recovered, leaving only the hapless investors in closed end MLP funds with any lasting damage since they’d had to deliver at the lows (see MLP Closed End Funds – Masters Of Value Destruction). The most recent 100-day correlation of oil and pipelines is close to the lowest in five years. Midstream earnings have been reliably good every quarter this year, with companies regularly meeting or beating expectations and offering improved forward guidance. This is what’s behind the 14% YTD return, meaningfully ahead of the S&P Energy ETF (XLE) which is –3% YTD.Although it’s not blindingly obvious from the correlation chart, the weaker recent relationship between crude prices and pipeline stocks has coincided with declining leverage. This makes sense – stronger balance sheets are better able to withstand fluctuations in throughput. We have always believed the sector’s sensitivity to commodity prices reflected the vagaries of investor sentiment more than revised expectations of cash flows. But as Debt:EBITDA has fallen back below 4.0X to 3.5X on its way towards 3.0X, the frustrating link with oil has moderated.

The most recent 100-day correlation of oil and pipelines is close to the lowest in five years. Midstream earnings have been reliably good every quarter this year, with companies regularly meeting or beating expectations and offering improved forward guidance. This is what’s behind the 14% YTD return, meaningfully ahead of the S&P Energy ETF (XLE) which is –3% YTD.Although it’s not blindingly obvious from the correlation chart, the weaker recent relationship between crude prices and pipeline stocks has coincided with declining leverage. This makes sense – stronger balance sheets are better able to withstand fluctuations in throughput. We have always believed the sector’s sensitivity to commodity prices reflected the vagaries of investor sentiment more than revised expectations of cash flows. But as Debt:EBITDA has fallen back below 4.0X to 3.5X on its way towards 3.0X, the frustrating link with oil has moderated. This has been accompanied by US crude output that recently set a new record of 13.2 Million Barrels per Day (MMB/D). Consensus early this year was that US production would grow slowly given the declining quality of undrilled shale wells and continued capital discipline. However E&P companies are demonstrating improved capital efficiency, producing more per dollar of capex. Chevron CEO Mike Wirth recently made this point on CNBC when Becky Quick asked why capex was lower than in recent years in spite of the recovery in prices and Administration pleas to pump more (for now, anyway).

This has been accompanied by US crude output that recently set a new record of 13.2 Million Barrels per Day (MMB/D). Consensus early this year was that US production would grow slowly given the declining quality of undrilled shale wells and continued capital discipline. However E&P companies are demonstrating improved capital efficiency, producing more per dollar of capex. Chevron CEO Mike Wirth recently made this point on CNBC when Becky Quick asked why capex was lower than in recent years in spite of the recovery in prices and Administration pleas to pump more (for now, anyway). Investors committing capital to the sector understand that current 6-7% yields are excessive given the declining risk profile. Infrastructure assets with visible, stable cashflows have drawn buyers this year even with the Fed raising rates.

Investors committing capital to the sector understand that current 6-7% yields are excessive given the declining risk profile. Infrastructure assets with visible, stable cashflows have drawn buyers this year even with the Fed raising rates. Tellurian (TELL) CEO Charif Souki was just ousted from Tellurian, the second time an LNG company he founded has given him the boot. TELL has struggled to get their Driftwood LNG facility started, in large part because Souki’s long-term bullish view on global natural gas prices led to TELL retaining price risk on their liquefaction contracts. The consequent higher risk profile has made financing harder to obtain. Delays have allowed buyers to cancel contracts, further imperiling the company’s ability to raise capital.The contrast with NextDecade (NEXT) is striking. Two years ago both companies were signing long-term contracts to supply LNG and negotiating with investors for the capital to build their respective greenfield LNG terminals. Breakthroughs and disappointments caused sharp moves in both stocks. But NEXT achieved Final Investment Decision (FID) on their Rio Grande facility in the summer. The market has become steadily more skeptical that TELL will similarly reach FID on their Driftwood project.Last month TELL warned investors there was substantial doubt about its ability to remain a going concern.Carl Icahn figured long ago that Souki was a visionary but not the guy you want running the business, which led to Souki’s ouster from Cheniere in 2015. His compensation has been notoriously high and divorced from tangible results. He was recently paid $20 million (watch Tellurian Pays For Performance in Advance). The board finally had enough. Souki’s oversized risk appetite and compensation persuaded us and many others to invest elsewhere a long time ago.

Tellurian (TELL) CEO Charif Souki was just ousted from Tellurian, the second time an LNG company he founded has given him the boot. TELL has struggled to get their Driftwood LNG facility started, in large part because Souki’s long-term bullish view on global natural gas prices led to TELL retaining price risk on their liquefaction contracts. The consequent higher risk profile has made financing harder to obtain. Delays have allowed buyers to cancel contracts, further imperiling the company’s ability to raise capital.The contrast with NextDecade (NEXT) is striking. Two years ago both companies were signing long-term contracts to supply LNG and negotiating with investors for the capital to build their respective greenfield LNG terminals. Breakthroughs and disappointments caused sharp moves in both stocks. But NEXT achieved Final Investment Decision (FID) on their Rio Grande facility in the summer. The market has become steadily more skeptical that TELL will similarly reach FID on their Driftwood project.Last month TELL warned investors there was substantial doubt about its ability to remain a going concern.Carl Icahn figured long ago that Souki was a visionary but not the guy you want running the business, which led to Souki’s ouster from Cheniere in 2015. His compensation has been notoriously high and divorced from tangible results. He was recently paid $20 million (watch Tellurian Pays For Performance in Advance). The board finally had enough. Souki’s oversized risk appetite and compensation persuaded us and many others to invest elsewhere a long time ago. More By This Author:Report From The Wells Fargo ConferenceBond Rally Boosts PipelinesAnother Climate Conference

More By This Author:Report From The Wells Fargo ConferenceBond Rally Boosts PipelinesAnother Climate Conference

Leave A Comment